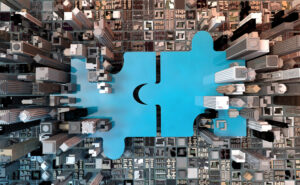

Major Microsoft Outage Demonstrates Escalating Cyber Risks to Global Commerce

The significant outage linked to IT giant Microsoft has caused widespread disruption, affecting banks, airlines, train companies, and media organisations – with dramatic implications for the global insurance industry as businesses worldwide report significant disruptions.