With a career deeply rooted in the healthcare industry, Sebastien Gaudin’s journey has been marked by unwavering dedication and a relentless pursuit of innovation.

Now leading an up and coming insurtech startup, he began his career in health after completing his masters in pharmaceutical and commercial sciences in France. He then began a twelve-year tenure at Sanofi, the globally renowned pharmaceutical giant, where he held pivotal roles in business development and marketing across diverse therapeutic areas and geographical markets.

It was during his tenure in China, that he managed the diabetes portfolio and discovered his passion for addressing unmet healthcare needs.

Driven by a vision to bridge the gap between consumers and healthcare services in China, he left Sanofi to co-found The CareVoice, an innovative digital health startup aimed at instilling trust and transparency in the healthcare sector. Insurtech Insights finds out more.

You founded The CareVoice back in 2014 – what prompted that move?

I have dedicated my career to innovation in healthcare.

In the first decade, it was related to pharmaceuticals, biotech and the next drug innovations that may transform how diseases are treated or controlled, and across various medical areas such as cancer, cardiology, diabetes, infection diseases…

Realising how important is the role of each individual to truly benefit from the treatment prescribed by their doctors and more broadly to be healthy, I was eager to play an active role in the emergence of digital health.

Driven by my entrepreneurial mindset and being in Asia where there was a strong need for empowering individuals with their health, I founded The CareVoice.

Since then, there have been massive changes in the insurtech/healthtech space – which stand out most to you and why?

Healthtech and insurtech have reached several stages of maturity. For some of the companies like CareVoice, we operate at the crossing of the two sectors and can observe some differences.

In healthcare, thanks to a solid market demand from consumers facing many problems while they have become more and more health conscious, I witnessed a massive growth of digital health companies fuelled by nearly unlimited access to capital. As a result, our way to consume healthcare has evolved drastically, from finding and booking a doctor, connecting online with specialists, or monitoring our health through various trackers. In life threatening diseases such as type 1 diabetes, the connected devices have transformed how people can live and control their illness. The access to medical professionals has been made convenient and consumer friendly, while saving time and driving efficiency for the system and medical professionals.

However, the healthcare journey remains highly fragmented, with many stakeholders’ involved and many “point solutions”, the bridge between enabling prevention and disease treatment is still barely established, and economic models that could sustain innovation are lacking.

In the insurance space, the first wave was mostly around new consumer brands bringing simplicity and transparency, and new distribution approaches. In health insurance, it was interesting to witness early moves such as Oscar Health to bring tangible digital-based health services and values as a key differentiation point. However, many got challenged by what is at the core of insurance, underwriting, claims – and have been exposed to high Combined Ratios in addition to increasing customer acquisition cost.

The latest wave which is now actively funded in which CareVoice belongs acts more as a technology enabler to insurers rather than a competitor. Though facing rather long sales, implementation and scaling up cycles, this category of players can contribute to deeply transforming how insurance companies operate and serve their customers.

You’ve just announced closing your Series B funding round. Can you tell us more about that and the current challenges in raising investment?

It has been a very challenging period for any tech companies. Insurtech and healthtech were part of sectors with high interest and funding from investors, and they got hit too. A recent report from FT Partners on insurtech investment shows that the 2023 total investment is three times lower than in 2021, which means there were very few companies able to get funded.

The average deal size was 50% higher back then which reflects two requirements for the funded companies: Firstly, clear demonstration of solid unit economics or even to be cash flow neutral; Secondly, bring the confidence to be capital efficient to deploy new capital to drive growth.

For CareVoice B round financing, we have been somewhat lucky though it has been a long and bumpy road! Actually, we were about to complete an even larger B round by mid 2022 but faced a last minute change as investors became highly valuation sensitive along with the overall market change. The multiples for valuation were moving from 10-12x the revenues to half or less making it difficult to raise a large amount of capital.

We adjusted our funding strategy, rolled up our sleeves, stayed highly focused on our major insurer clients, and have managed to be cash flow neutral, without cutting any headcount, while driving the growth of revenues. Eventually, we were in a good position to complete our Series B led by Apis Partners with whom we have been working closely to jointly drive growth opportunities.

What’s happening in terms of scaling the business?

We doubled the revenues in 2023 vs 2022 while being cash-flow neutral for the past 18 months by working closely with several major global insurers. We expanded existing and newly signed commercial collaboration, scaling to reach up to several million of customers, and covering already over 15 countries across the globe.

Here are three examples of collaboration with life and health insurers, powering their health and wellness customer engagement Super Apps.

With MetLife EMEA, we collaborate on the 360Health programme initially launched in Asia. We started from the Gulf countries. After a first quick release, we made some continuous upgrades and reached first KPIs, and are being scaled to 100.000 customers while preparing for other EMEA countries.

With Prudential Financial, we enabled the replacement of the Vitality App that was launched in Brazil and Argentina by a more holistic offering within the Fully SuperApp addressing three wellness dimensions – physical (where Vitality fits), mental and financial wellness.

With AXA, which was our very first insurer customer in Asia, we are implementing a brand new App for their UK headquartered international medical insurance. More to come soon!

Finally, as our solutions for insurers have “connections” with the whole value chain, we prioritised not only establishing our platform interoperability but also signing strategic partnerships with global players such as reinsurer, digital distribution enabler, … in order to jointly serve insurers and augment our respective capabilities. For instance, we announced a few months back the collaboration with InsureMO, a global leading middleware platform for insurers.

What are the biggest barriers to success in this sector at the moment, and why?

I think that we can summarise this into three main areas.

First – What is the business case? Digital health and wellbeing needs to become more than a marketing / branding exercise and actually demonstrate an impact on the revenue and profitability of Insurers. Achieved through driving top line growth, reducing costs and impacting claims. This needs an ability to constantly evolve the proposition and enable the use of data to drive customer engagement and link to pricing and underwriting approaches.

Second – What is the right partnership and technology model? We see that Insurers are grappling with the build vs buy conundrum. What is clear is that insurers want to build the capability to design and drive innovative products with digital services attached to core insurance products. We enable our clients to find the right balance by providing them with our ecosystem technology that allows them to have the right service proposition and the tools to drive engagement.

Third – It’s all about customer experience. In the end this sector is about providing solutions that customers want to use, not once, but on an ongoing basis. The engagement approach, delivering value for the end user, is the main problem that insurers are trying to solve. The answer of course is to have the technology that allows both data-driven personalization and the ability to constantly evolve the experience.

What new technologies are you personally most impressed with in the healthtech/insurtech space?

Digital health technology is rapidly changing the way healthcare is delivered. Artificial Intelligence (AI) and Machine Learning (ML) are the most prominent tech and healthcare trends. Thanks to advancements in deep learning and AI video processing, it is now possible to analyze the human face for real-time vitals measurement.

We deployed this technology with a few insurers. Their customers can easily get to know their blood pressure, breathing rate, heart rate, stress level etc by taking a selfie with the mobile. Another use case we have validated and can be made available via our platform is personalized brain training. AI algorithms can analyze end user’s cognitive skills, meaning concentration, focus, memory, coordinations, and more importantly, recommend brain training based on your personal level and improvements.

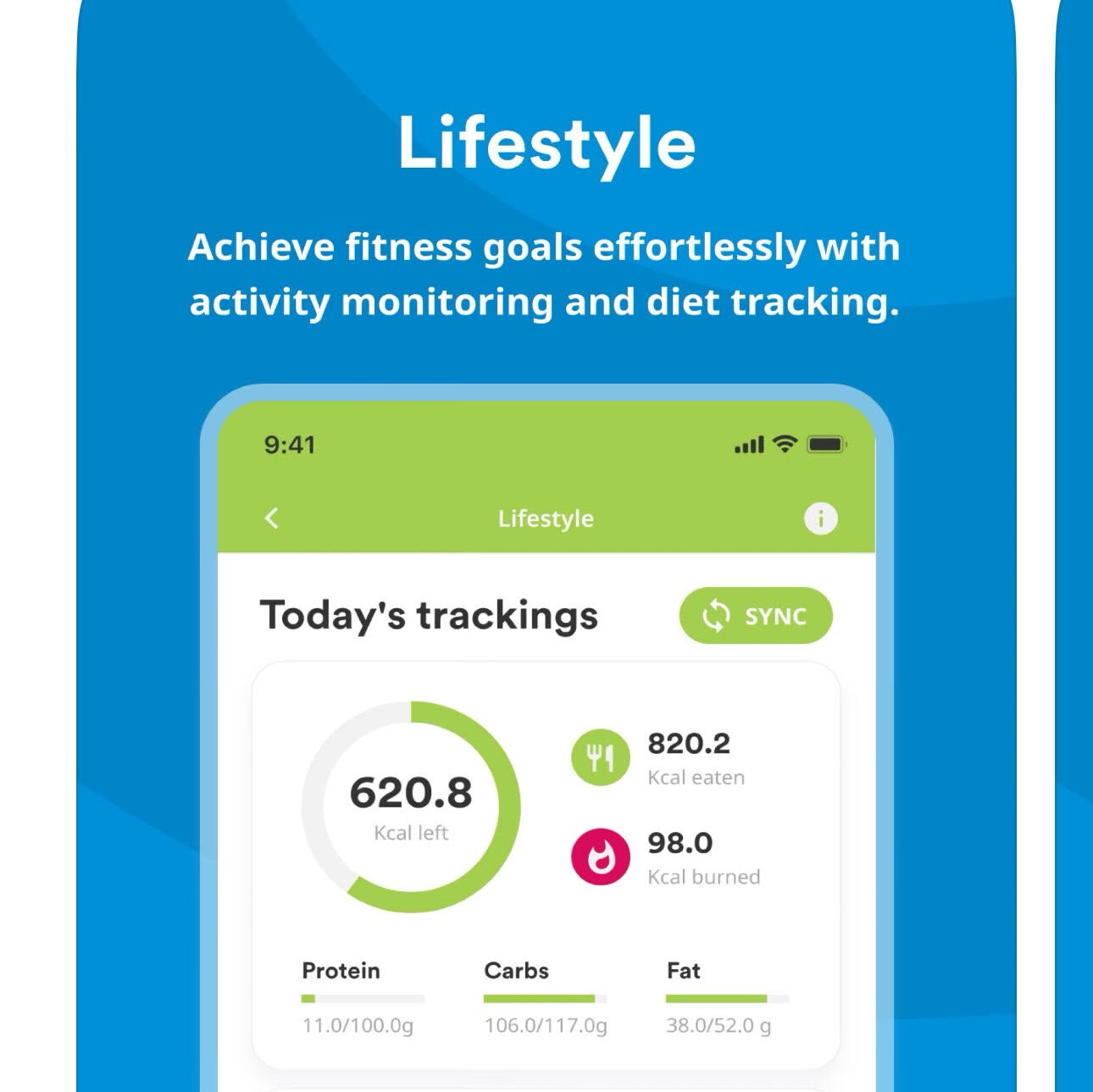

IoT and wearables are widely used in the healthcare space. Trackers like smartwatches, fitness bands, and other wearables can easily track physical health level, drive healthier behaviors, and offer tailored tips to maintain the healthy routines. Combining physical activity with nutrition behavior is highly synergistic and unlocks more values for the end-users to achieve his/her personal goals. For specific populations such as pregnant women, children or Chronic diseases, connected devices can deeply improve understanding of individual health and support data-driven decisions and actions.

Building our own service ecosystem and working closely with different healthtech companies, I’ve witnessed numerous new technologies and players coming into this area. It’s important that we can identify really viable solutions and qualified players to be part of our offering to insurers and their customers. Therefore, we have set up a dedicated arm called Embedded Health Lab, working with selected partners, building and validating prototype products ahead of their launch into our customer solutions. The upcoming one is related to sleep tracking and improvement.

What new products and services can we expect from The CareVoice in the next 12 to 18 months?

We are focused on two things: engagement management and health values for the end users.

Engagement is a big word in which a lot of start ups and customer facing apps are doing very well. However, when applied in the insurance industry, you are interfaced with legal/compliance issues, data requirements and more importantly alignment on how engagement strategy works with the business level. A massive tackle in our product line is around how to create a platform that fills the missing gap of engagement “capabilities” of insurers.

Our goal is definitely to enhance our product stack to make the “operational management” of engagement easier for our clients or any team that is put on the task of improving usage of an app. AI and ML as mentioned earlier are definitely a key technology to make this process “more intelligent” such to reduce operational cost. Our R&D will innovate heavily in this area such that the next generation of CarevoiceOS can help scale, reduce implementation costs and assist our clients to actually make engagement work.

The second area where we are focusing on is how our platform can help deliver added value services from a variety of health innovations on the market to our clients (cf. previous question and our Embedded Health Lab initiative). Not only will CarevoiceOS become a bridge, we will set a standard of an ecosystem that drives interests.

Behaviour change is obviously hard and takes time. CarevoiceOS is going to be further enhanced to assist behaviour change by delivering value and good experience to the end-user rather than trying to forcefully change something.

We believe with the ecosystem and an interoperable platform that we open to the market, endless opportunities then become possible for everyone to contribute.