In a recent deep dive, a Reuters Special Report has shed light on the shortcomings of Tesla’s car insurance service, stating that offerings are currently falling short of expectations.

The investigation reveals that understaffing issues within Tesla have resulted in some customers facing extended wait times, ranging from weeks to months, for compensation, all while continuing to make payments on their damaged vehicles.

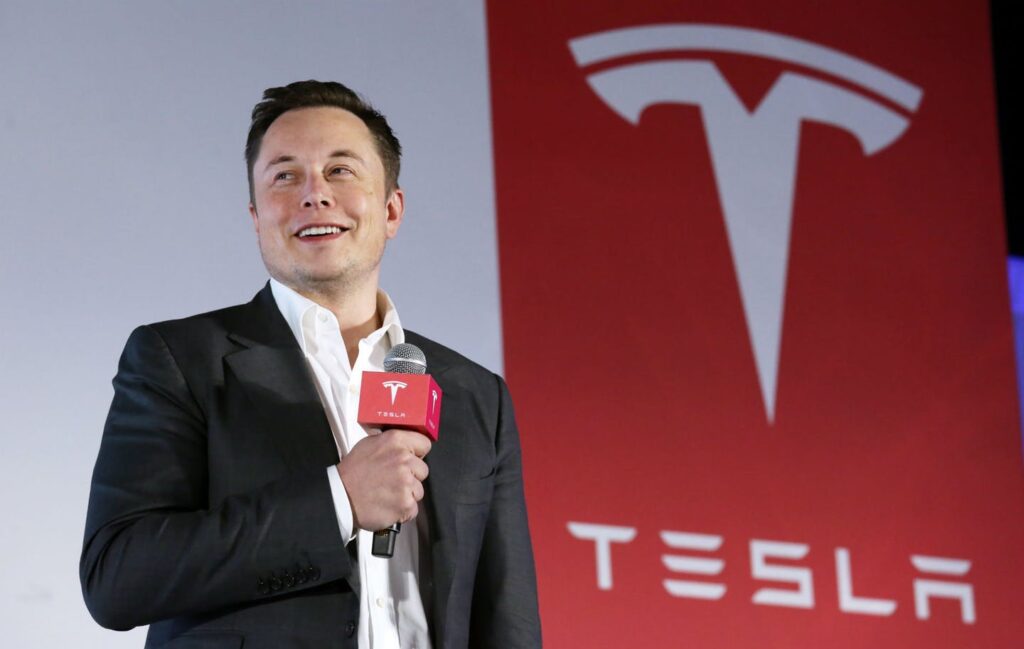

Elon Musk, Co-Founder and CEO of Tesla Motors, had previously pledged to offer more affordable and superior auto insurance, even describing it as “revolutionary,” in response to Tesla experiencing a decline in sales attributed to high insurance premiums.

Tesla set out to ‘reinvent’ the car insurance market

In May 2022, Musk spoke publicly about the growing importance of Tesla’s new car insurance offering, which he said aimed to redress the “incredibly inefficient” process that is keeping premiums high for many drivers.

At the All-In Summit in Miami, he asserted that the solution was “quite significant now because the car insurance thing is a bigger deal it may seem,” and noted that many drivers are forced to pay a significant proportion of the lease payment for their vehicle over and over again in insurance premiums. He also noted that the problem lay in what he described as an unnecessary number of “middle entities” involved in the insurance process.

“The car insurance industry is incredibly inefficient because you’ve got so many middle entities,” Musk said. “From an insurance agent all the way to the final reinsurer, there’s like a half a dozen companies each taking a cut.”

“And it’s all very statistical. So even if you’re a very good driver, like you could be 20 years old and a great driver, it’s all statistical. So you either can’t get insurance or it’s extremely expensive.”

Higher premiums set for Teslas based on frequent claims data

However, in 2015-2016, the Highway Loss Data Institute revealed Teslas had higher collision and property damage claim frequencies than traditional luxury cars. AAA-The Auto Club Group responded in 2017 by raising rates up to 30% for Teslas, a move contested by Tesla.

Attempting to tackle the cost issue, Tesla introduced InsureMyTesla in partnership with Liberty Mutual in 2017, but it faced criticism for high premiums. Eventually withdrawn from the US, Tesla Insurance launched in California in 2019, promising reduced rates. However, partnering with State National Insurance, known for high consumer complaints, raised concerns about Tesla policyholders’ experiences.

Customer frustrations run high at Tesla customer service failures

The Reuters report went on to highlight widespread frustration among Tesla Insurance customers, with discontent surfacing on social media, online forums, and the Better Business Bureau website. Reuters’ investigation, involving conversations with policyholders, reveals a divided customer base.

While some applaud the insurer for competitive premiums, others voice dissatisfaction, citing prolonged wait times for claim payouts and repairs, alongside challenges in reaching claims adjusters.

Tesla Insurance expanded into 11 more states and recruited adjusters in Texas and Maryland, reports persist of prolonged repair delays and customer service challenges.

Tesla’s entry into insurance aimed to address potential customers shying away due to high electric vehicle collision-repair costs. Despite Elon Musk’s commitment to revolutionising auto insurance, operational challenges emerged, including periods of constrained budgets and understaffing, notably with around a dozen overwhelmed adjusters.

These issues within Tesla Insurance could align with a broader pattern of hurried and suboptimal management within Elon Musk’s vast tech and manufacturing empire. Initial adjusters in Draper, Utah, the report said, faced an extraordinary workload, handling hundreds of claims without the support of separate call centres.

Contrary to bold assurances, documented customer experiences reported by Reuters, sharply contrast with Elon Musk’s promises of an exceptional and efficient insurance service. Musk criticised the traditional auto insurance process as a “nightmare,” vowing that Tesla Insurance would transform this ordeal into a customer-friendly dream.

Despite efforts to expand and enhance services, Tesla Insurance continues to grapple with operational hurdles, prompting ongoing scrutiny from policyholders.

Author: Joanna England