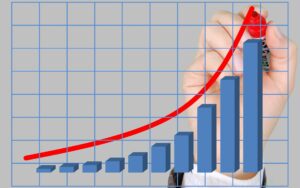

Safe Guard Receieves New Investment

Safe-Guard Products has announced a new investment from Hellman & Friedman, a private equity firm. Founded in 1992 and based in Georgia, Safe-Guard Products is a provider of third-party private label finance and insurance protection products for the automotive, RV, marine, and powersports industries.