The new capital will allow the company to accelerate growth, increase product velocity, and build upon their success with the platform powering more than 3,500 companies across a broad range of verticals. Nevcaut Ventures led the round, with participation from Elefund, Nimble Partners, LocalGlobe, 9Yards Capital, Global FinTech Venture Partners, and more.

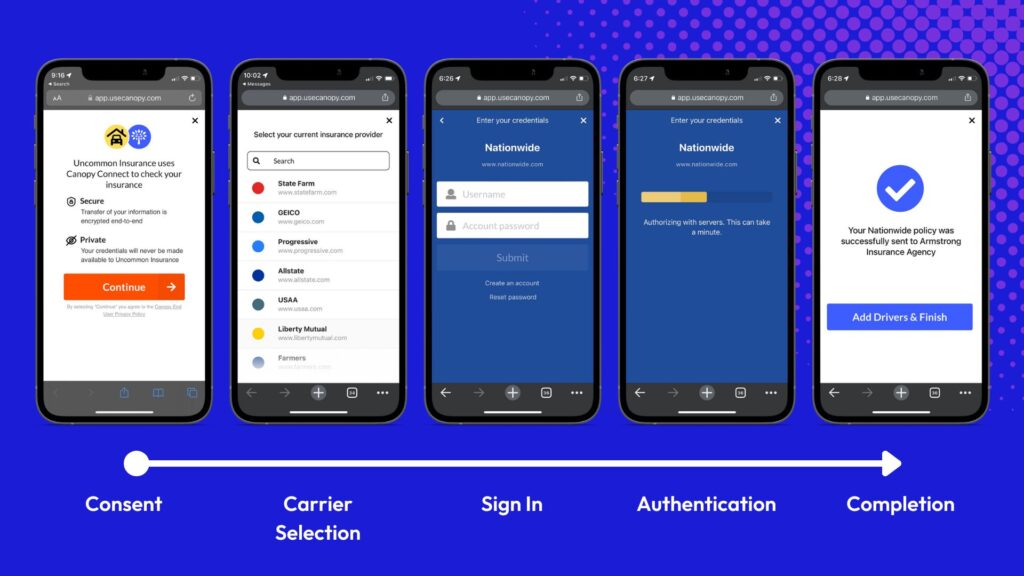

According to reports, Canopy Connect is the first insurtech of its kind to exchange verified insurance information. For this reason, insurance information is largely exchanged manually today between insureds and the businesses that serve them.

Launched in 2020, the company’s founders set out to build a missing, key piece of infrastructure for the insurance market—a platform for exchanging verified insurance information. Canopy Connect honed its infrastructure with insurance agencies first, removing the friction from the insurance quoting process by making it easy for people to share verified insurance information with their agent.

Funding will be used to expand Canopy Connection’s current offerings

In a statement released by Canopy Connect detailing the motivating event that resulted in the company’s launch, it said: “A conversation with an insurance agent inspired the idea when she (the agent) explained how she was driving to her client’s homes to help them download a declaration page so she could advise them and provide a competitive quote. She found this preferable to asking dozens of questions over the phone or having prospects fill out long forms—in either instance, they often didn’t know essential information and the insurance policy was unverified.”

Today, more than 3,000 insurance agencies rely on Canopy Connect’s unified insurance verification API to collect verified insurance information directly from the carrier and sync it to their comparative rater, CRM, or agency management system—all in a matter of seconds.

The insurance sector is trailing behind the financial services industry in embracing digital advancements, resulting in a widening technology gap. The disparity highlights the imperative for increased digital transformation within the insurance industry to stay competitive and align with the changing expectations of stakeholders. In addressing this need, Canopy Connect has emerged as a pivotal solution for businesses requiring streamlined insurance verification processes.

“There are so many use cases that can leverage our core insurance verification capabilities in lending, finance, insurtech, driver management, B2B verification, compliance and more,” said Tolga Tezel, founder and CEO at Canopy Connect. “This infusion of cash enables us to expand our connected insurance capabilities and meet the needs of these markets.”

Data shows that since 2022, Canopy Connect has seen increasing adoption within insurance carriers, embedded insurance companies, digital wallet apps, and other insurtech companies to remove friction from acquiring and verifying insurance information via API. They’ve also found success with auto lenders, mortgage companies, and loan servicers that use Canopy Connect for verifying insurance policies at origination as well as monitoring policies for loan servicing.

“The insurance world is in the midst of a profound digitization, Canopy Connect is a driving force, expediting this inevitable shift,” said Dan Quan, co-founder and general partner at Nevcaut Ventures. “We’re excited to lead this round and support Canopy Connect’s innovative vision to transform and evolve the industry and everything it touches.”

As Canopy Connect continues to make waves in the insurtech industry, Serik Kaldykulov, managing partner at Elefund, expressed unwavering confidence, stating, “Knowing Tolga and his team’s vision, it was a no-brainer to continue investing in Canopy Connect. We continue to be impressed by how quickly they’ve built leading products for insurance agencies, auto lenders, and mortgage companies, and we are excited to see what breakthroughs they make as they expand into new verticals.”

Author: Joanna England