According to the latest stats from Gallagher Re, insurtech sector funding experienced a notable decline in the second quarter of 2023. Data shows that new funding for the industry dropped to $916.71 million, marking a 34% decrease from the previous quarter’s total of $1.39 billion.

This is the first time in three years that quarterly funding has fallen below the $1 billion mark. Despite the decline, the average deal size only decreased by 16.1% to $12.39 million. However, early-stage funding in the sector reached its lowest point since Q3 2017, with life and health insurtech companies receiving $58.34 million and property and casualty insurtech seeing $157.71 million in funding.

However, while stats suggest one scenario, individual companies can show another. We’ve rounded up some of the most notable funding rounds of the past fortnight in the insurtech space to show that despite the dampened figures, insurtech investment is still thriving.

12. MyCover.ai: US$1.25 Million

CEO: Adebowale Banjo

Location: Nigeria

Nigerian insurtech startup, MyCover.ai, secured $1.25 million in a pre-seed funding round led by Ventures Platform, along with support from Founders Factory Africa and Techstars. Since its establishment in 2021, MyCover.ai has been dedicated to addressing various challenges in the African insurance industry, including limited access, inadequate coverage, high insurance costs, and poor customer experiences. Through an open insurance API, MyCover.ai offers more than 30 customised insurance products in collaboration with top insurance providers like Hygeia, Leadway, Sovereign Trust, AIICO Insurance, and Allianz. The funding will be used to strengthen internal operations, enhance technological capabilities, and expand into other African markets.

11. DESAISIV: US$2 Million

CEO: Saed Khawaldeh

Location: Saudi Arabia

DESAISIV has successfully raised $2 million in a pre-seed funding round led by 500 Global, Terra VC, Oqal, family offices, and investors with insurance backgrounds across MENA, UK, and USA. Co-founded by Saed Khawaldeh and Mohamad Nabhan, DESAISIV offers AI-powered SaaS products for medical insurance companies and third-party administrators. The funds will be utilised to further develop their product, expand their client base, and grow their geographical presence. DESAISIV aims to revolutionise the insurance sector by leveraging AI, streamlining insurance processes, and creating a personalised and efficient customer experience.

10. Wellx: US$2 Million

CEO: Vaibhav Kashyap

Location: UAE

Wellx, a groundbreaking health and wellness-focused insurtech platform based in the UAE, successfully raised $2 million in a seed funding round. The investment, led by Dubai Future District Fund (DFDF), alongside a diverse group of investors including MENA-focussed DASH Ventures and international VC firms, marks a significant milestone for the start-up. Co-founded by Vaibhav Kashyap, Javed Akberali, and Dr. Anushka Patchava, Wellx uses embedded behavioural science and gamification to empower users and incentivize healthier habits. The funding will fuel regional growth, drive technological innovation, and enhance the platform’s customer-centric approach, disrupting the insurance industry and delivering personalised insurance experiences.

9. Modives: US$3 Million

CEO: Frederick Waite

Location: North Carolina

Modives successfully raised $3 million in seed funding to revolutionise insurance verification for property managers and auto dealers. The innovative platform aims to simplify the traditionally laborious verification process, enhancing customer experience. CEO Frederick Waite, an insurance industry veteran, leads the venture, backed by a strong leadership team with expertise in the field. The funding will further develop Modives’ platform, streamlining insurance verification in the auto and property industries. The startup targets an ambitious goal to modernise the decades-old verification process, bringing efficiency and ease to car sellers, property managers, and customers.

8. Percayso: US$3.4 Million

CEO: Richard Tomlinson

Location: London

UK-based Percayso Inform has successfully raised $3.4 million in a funding round led by industry veteran Neil Utley and existing investor Praetura Ventures. The firm’s data and intelligence hub empowers insurers to combat fraud, compete on price comparison sites, and mitigate risk. Boasting a client base of 65 companies, including Ageas, Covea, Direct Line, and The AA, Percayso Inform has garnered attention in the insurance industry. The funding will support the growth of Percayso Vehicle Intelligence, tapping into Neil Utley’s expertise in the motor insurance market. The company’s technology aggregates data from multiple sources, transforming it into valuable insights for insurers.

7. Ennabl: US$8 Million

CEO: Kabir Syed

Location: Connecticut

Ennabl secured $8 million in Series A funding, led by Brewer Lane Ventures. The data analytics platform empowers insurance brokers with machine learning-driven growth strategies, extracting and enriching data from various systems to offer actionable intelligence. The funding will support product development, sales and marketing expansion, and overall company growth, driving Ennabl’s market reach and industry impact. Since its 2021 launch, Ennabl has amassed a significant customer base, including major insurance brokers, and formed strategic partnerships with key technology providers. CEO Kabir Syed is optimistic about the platform’s potential to simplify processes and enable brokers to achieve their goals, while Brewer Lane Ventures sees immense promise in Ennabl’s data-driven approach.

6. CompScience Insurance Services: US$10 Million

CEO: Josh Butler

Located: San Francisco

CompScience Insurance Services, a San Francisco-based computer vision insurtech firm, raised $10 million in Series A funding led by Valor Equity Partners and joined by Four More Capital. The funding will fuel expansion into new industry verticals, technology enhancement, and team strengthening for risk management services. CompScience uses AI-powered safety analytics and visual AI to analyse workplace security video, offering risk mitigation services for workers’ compensation policies or SaaS offerings. With partnerships including Swiss Re and Nationwide, the company experienced a tenfold growth in its insurance business and a 23% reduction in injury rates this year. The funding accelerates CompScience’s trajectory as a leading insurtech innovator.

5. Foxquilt: US$12 Million

CEO: Mark Morissette

Location: Toronto

North American insurtech firm, Foxquilt, raised $12 million in funding across two rounds, led by ICM and with participation from existing and new investors. The company specialises in insurance solutions for small businesses and micro-enterprises. Utilising proprietary technology and data analytics, Foxquilt offers fully automated, multi-operational coverage through B2B enterprise and Broker/Agent distribution channels. The firm’s embedded insurance technology seamlessly integrates insurance products into various platforms, removing barriers for customers and enhancing user experience.

The Series B funding will fuel North American expansion, technology infrastructure enhancement, and the development of data analytics capabilities, driving Foxquilt’s continued growth and profitability forecast by the end of 2023.

4. Certificial: US$15 Million

CEO: Peter Teresi

Location: North Carolina

Certificial, the Holly Springs-based fintech firm offering business insurance monitoring solutions, secured over $15 million in new funding from investors, including Nyca Partners. The company’s “Smart COI Network” provides real-time Certificates of Insurance for simplified compliance management, serving over 60,000 firms. Experiencing remarkable growth with 40 times more transactions in the past year, Certificial made Inc. magazine’s Best Places to Work list and operates as a fully remote employee company since its 2021 inception. The fresh capital will fuel Certificial’s mission to create an innovative data-driven network, transforming insurance sharing and replacing traditional communication methods.

3. Converge Insurance: US$15 Million

CEO: Tom Kang

Location: California

Converge Insurance secured $15 million in Series A funding led by Forgepoint Capital. The cyber risk management and underwriting pioneer aims to address the critical need for cyber insurance among small to medium-sized businesses (SMBs). With 61% of SMBs being targets of cyberattacks and 60% going out of business within six months of an attack, Converge’s modern managing general agent (MGA) platform offers transparent cyber risk solutions. Tom Kang is appointed CEO to drive the company’s mission of empowering policyholders with precise cyber insurance. The funding will fuel global expansion, partnerships, and platform development, revolutionising the cyber insurance industry.

2. Lula Technologies: US$35.5 Million

CEO: Matthew Vega-Sanz

Location: Miami

Lula Technologies Inc., a burgeoning startup in the insurance software sector catering to vehicle fleet operators, secured a significant $35.5 million in funding through its Series B round. Key investors, including Khosla Ventures and NextView Ventures, spearheaded the funding, alongside the participation of notable backers such as Stephen Pagliuca of Bain Capital.

Launched in 2020, Lula’s platform facilitates insurance coverage for trucks and also offers policies against cargo damage. Expanding its services to rental car providers and other fleet-based companies, Lula provides standard auto insurance as well as flexible pay-as-you-go plans based on daily or per-mile payment options.

The platform streamlines the claims process through automation, while LulaSafe employs machine learning algorithms to consolidate driver information. With substantial customer growth and revenue increase, Lula plans to launch new insurance services and an embedded insurance tool to bolster business momentum.

1. Tractable: US$65 Million

CEO: Alex Dalyac

Location: London

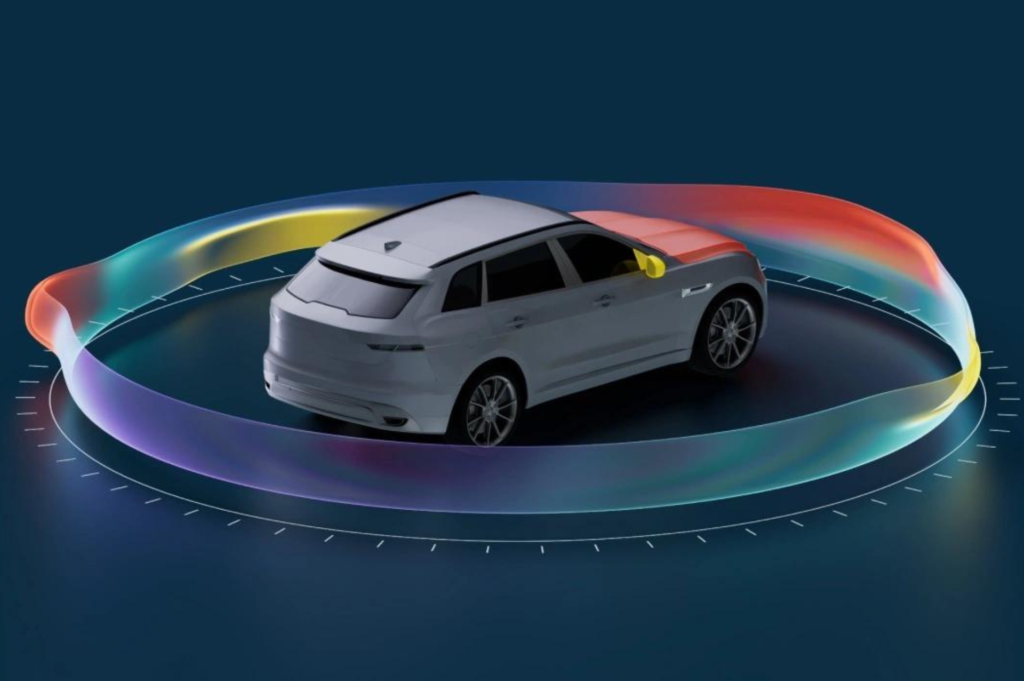

Applied AI company Tractable secured $65 million in Series E funding, led by SoftBank Vision Fund 2, alongside Georgian and Insight Partners. Tractable specialises in visually evaluating vehicles and homes for insurance firms, employing AI for enhanced precision and efficiency.

The funds will accelerate research and development to introduce new features. The global insurance market’s expected surge to $4.3 trillion in premiums by 2040 demands transformation in claims processing. Tractable’s visual AI swiftly analyses user-submitted smartphone pictures, delivering accurate damage assessments, streamlining evaluations, and expediting auto collision industry processes.

Notably, the company has already formed alliances with acclaimed clients like American Family Insurance, Aviva, and leading automotive entities. The successful funding round marks Tractable’s continued commitment to revolutionising the insurance landscape for a more streamlined and cost-effective claims journey.

Written by Joanna England

Joanna England is an award-winning journalist and the Editor-in-Chief for Insurtech Insights. She has worked for 25 years in both the consumer and business space, and also spent 15 years in the Middle East, on national newspapers as well as leading events and lifestyle publications. Prior to Insurtech Insights, Joanna was the Editor-in-Chief for Fintech Magazine and Insurtech Digital. She was also listed by MPVR as one of the Top 30 journalist in Fintech and Insurtech in 2023.