The funding round was led by prominent venture capital firms Redpoint Ventures and Mundi Ventures, marking a significant milestone for the company.

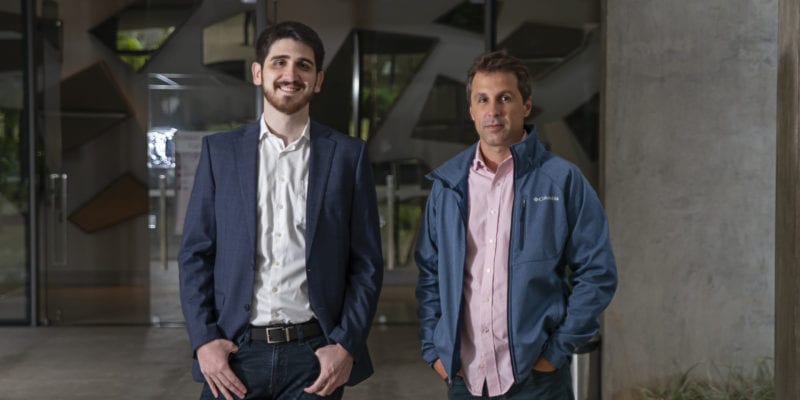

The healthtech, founded by Guilherme Berardo and physician Dr. Vitor Asseituno (pictured), started operating in 2020 and plans to use the new funding to offer an increasingly positive experience to its more than 18 thousand active members by implementing new technological tools and optimizing existing ones.

The investment is significant because although Brazil offers universal health care, approximately 25% of the population, equivalent to around 48 million individuals, opt for private insurance in search of more efficient and superior healthcare services. Sami’s innovative approach aims to address this gap in the market.

Sami’s latest funding round signifies a significant stride toward its mission of revolutionising primary care in Brazil. With its innovative approach and commitment to cost reduction, the company is poised to create a positive impact on the healthcare landscape and improve access to quality care for millions of Brazilians.

Sami can significantly reduce the cost of care

According to reports, Sami distinguishes itself by functioning as both the primary health care provider and the insurance company. By assuming both roles, Sami can significantly reduce the cost of care.

“In such a difficult time for startups to raise investment, this funding reinforces Sami’s prominence and performance, and the confidence of investors in the company’s potential,” says Vitor Asseituno, president of Sami.

Speaking about the new injection of capital, CEO Guilherme Berardo said that the insurtech leverages its vested interest to negotiate lower prices for consumers. Additionally, Sami relies heavily on digital platforms, such as text messages, video calls, and its own app, for about 95% of its primary care operations.

He explained that Sami generates revenue by actively working to lower hospital admission rates through effective clinical intervention. While the company has achieved a 30% margin on every dollar of premium written, it has yet to achieve profitability at the bottom line.

Dr. Vitor Asseituno, President of Sami, said that to keep the company’s growth sustainable, tech innovation combined with human expertise will continue to help the company scale. “Sami is promoting a change in the health culture in Brazil. Our model, already practiced in countries like Canada and England, is still new here. We combine science, technology and human expertise to provide highly personalized, quality health careTo this end, customers have a Health Team – comprised of a general practitioner (GP), a coordinator and a nurse – at their disposal either virtually via the Sami app or in-person.”

Currently, Sami presently boasts a user base of approximately 18,000 individuals. Since its inception, the company has secured a total of $53 million in funding from notable investors, including Monashees and Valor Capital. However, although Berardo did not disclose the exact valuation of the company, he confirmed that it currently stands below $500 million.

Future strategies for scaling Sami

The latest funding will help Samil in its core aim, which involves targeting gig economy workers and small businesses. The insurtech is now poised to expand its operations to larger clients. However, as the company ventures into this new segment, it will face increased competition from existing players in the private insurance market. Berardo acknowledges that securing partnerships with companies employing 400 to 500 individuals will present challenges, as they are typically already insured through incumbent providers like United Health-controlled Amil and Hapvida.

Additionally, Alice, another Brazilian healthtech company that combines primary care with insurtech, has also attracted significant venture capital investment.

Asseituno added: “Our members’ journey is based on their health and socioeconomic status, and our preventive and proactive care takes all of this into account so that we can look at their health in a holistic, comprehensive way — and not simply treat diseases.”

Source: Sami