EPIC Acquires Century Insurance Group

EPIC Insurance Brokers and Consultants has completed the acquisition of US-based Century Insurance Group for an undisclosed sum.

Acquisitions

We regularly curate the latest news and insights to create the largest platform for knowledge-sharing and development within the world’s insurance industry.

EPIC Insurance Brokers and Consultants has completed the acquisition of US-based Century Insurance Group for an undisclosed sum.

German insurer Allianz announced on Wednesday that it plans to buy a majority stake in Singapore’s Income Insurance for around $1.6 billion, as it seeks to strengthen its position in Asia.

Heffernan Insurance, one of the largest independent insurance brokerage firms in the United States, has announced the acquisition of Costello Insurance Associates, a move that officially adds aviation expertise to its extensive range of services.

Hub International Limited (Hub) has expanded its footprint in Tennessee with the acquisition of Wyatt Insurance Services, Inc.

Marsh McLennan has announced the acquisition of The Horton Group, a leading insurance brokerage and one of the top independent insurance brokers. The terms of the deal have not been disclosed.

Unum Group has announced a definitive agreement to sell its Medical Stop Loss business to the Amynta Group, an insurance services company.

An EY report has highlighted a significant increase in publicly disclosed M&A deals in the UK insurance industry, rising from 54 deals in H1 2023 to 94 in H1 2024. The overall deal value has also surged from £400 million to £900 million.

Shares in Hiscox surged as much as 14% on Monday following reports that two foreign rivals are considering takeover bids for the Lloyd’s of London insurer.

Utmost Group has announced an agreement to acquire Lombard International Assurance Holdings, subject to regulatory and other approvals.

Charles Taylor, a leading provider of international adjusting services and technology solutions for the global insurance market, has acquired US.-based independent loss adjuster M3 Aviation Services, effective June 27, 2024.

Novidea, the creator of a cloud-based, data-driven enterprise insurance management platform, has announced the strategic acquisition of Docomotion, a leader in automated document generation technology. The acquisition is expected to close within the week.

UK-based life and pensions data management and technology company ITM has been acquired by Lumera, a European insurtech firm specialising in life and pensions solutions.

Zurich Insurance Group (Zurich) has announced an agreement to acquire AIG’s global personal travel insurance and assistance business (AIG Travel) for USD 600 million, with an additional potential earn-out payment. The move will also boost Zurich’s position as a leading travel insurer in the US and globally

PCF Insurance Services, one of the top twenty US insurance brokers operating across 40 states, has announced the acquisition of four key agencies: Ignitist in Pennsylvania, The Brady Agency in North Carolina, Roseberry Insurance Agency in Mississippi, and The Sinnott Agency in Iowa.

Zurich Insurance has announced the acquisition of a 70% stake in Kotak Mahindra General Insurance Company Limited (“Kotak General Insurance”), marking a significant milestone as the first foreign insurer to enter India since the foreign direct investment (FDI) rules were amended to allow up to 74% foreign ownership in 2021.

bolttech has announced that Digital Care, a Poland-based device protection and services provider, has been renamed and rebranded as bolttech Poland.

AM Specialty Insurance Company (ASIC), an Excess and Surplus (E&S) insurance firm and an accredited reinsurer, announced it has completed the acquisition of Pinpoint Insurance Solutions, an MGA, surplus lines brokerage, and national programme administrator.

DOXA Insurance announced it has acquired specialty MGA CPH Insurance, which caters to the professional liability needs of mental health, allied health, and healthcare professionals.

Brown & Brown, the global insurance brokerage, has announced it has acquired 100% of Northern Ireland-based Rollins Insurance Brokers.

Fixle, Inc., a prominent provider of home management solutions in the proptech and insurtech sectors, has announced its acquisition of EasyHome, Inc., a software developer specialising in modernising property care and management.

Ambac Financial Group, the Insurance holding company has agreed to acquire 60% controlling interest in London-based insurer and MGA Beat Capital Partners for $282 million.

Arthur J. Gallagher has announced that its specialist underwriting subsidiary Pen Underwriting has acquired Irish-based MGA Wrightway Underwriting Limited .

NSM Insurance Group, a Global Specialty Insurance Provider, operating more than 25 niche insurance programmes, announced it has completed the acquisition of Strategic Underwriters International, an MGA in the casualty facultative reinsurance marketplace.

Marsh McLennan agency announced it has acquired Perkins Insurance Agencies, an independent agency based in Abilene, Texas as Marsh seeks to expand its offerings in West Texas.

Inszone Insurance Services announced that it has acquired T Blackwell Insurance Group, as it Continues its Recent Spree of Deals

Marsh McLennan, the Global Re/Insurance broker has announced the launch of Sentrisk, an AI-Powered platform which offers integrated advisory services. Sentrisk aims to reshape the way that businesses manage their global supply chain risks.

Howden has announced the acquisition of MiCRO, a microinsurance specialist focused on providing parametric insurance coverage to underserved populations in Latin America, specifically against natural catastrophes.

Zurich-based Lloyd’s coverholder Amboss Underwriting (Amboss) has assumed the downstream portfolio of Oilfield Insurance Agencies’ Zurich branch.

Aon has completed the acquisition of middle market property and casualty broker NFP from Madison Dearborn Partners and HPS Investment Partners.

Marsh McLennan Agency, a subsidiary of Marsh, has announced its intent to acquire Fisher Brown Bottrell Insurance, Inc. (FBBINSURANCE) from Trustmark National Bank in a significant all-cash transaction valued at $345 million.

Arthur J. Gallagher & Co., has announced its acquisition of Australia’s Prasidium Credit Insurance. Details of the transaction have not been disclosed.

Chubb has announced a definitive agreement to acquire Healthy Paws, a U.S.-based managing general agent (MGA) specialising in pet insurance, from Aon plc (NYSE: AON), a global professional services firm.

Omaha National, a leading provider of workers’ compensation insurance, has successfully acquired Sutter Insurance Company.

Resideo Technologies, Inc. has announced that it has entered into a definitive agreement to acquire Snap One Holdings Corp.

Arch Insurance North America, a division of Arch Capital Group, is set to acquire Allianz Global Corporate & Specialty’s US MidCorp and Entertainment insurance businesses.

Generali Investments Holding S.p.A. (GIH), a key player in the investment sector and a subsidiary of Generali Group, has announced the acquisition of Conning Holdings Limited (Conning), a prominent global asset manager.

In a strategic move, Dai-ichi Life Holdings, a prominent Japanese insurance company, has announced its acquisition of a minority stake in Canyon Partners, a leading alternative investment manager based in the United States.

Aon has announced its acquisition of Humn.ai’s technology assets and intellectual property, aimed at bolstering its commercial fleet proposition.

London-based insurance intermediary group, Howden, has announced its acquisition of Intersure Group Ltd., operating as Intersure Group, in a move aimed at bolstering its service capabilities in the Irish insurance market and expanding its reach across the country.

Marsh McLennan Agency (MMA), a subsidiary of Marsh, has announced its plans to acquire two Louisiana-based middle-market agencies, Querbes & Nelson (Q&N) and Louisiana Companies, in a strategic move aimed at bolstering its regional presence.

Resilience expanded its capabilities through the acquisition of BreachQuest, an innovative incident response technology solution.

Zinnia has announced its acquisition of the life and annuity assets of Ebix, a renowned supplier of software solutions.

Wipro, a leading global IT firm based in Bengaluru, India, has acquired a majority stake in US-based Aggne Global, a prominent consulting and managed services firm specialising in insurtech.

Zurich Insurance Group, a prominent Switzerland-based insurer, has received approval from Indian competition regulators for its acquisition of a 70% stake in Kotak Mahindra General Insurance Company (KMGIC).

RiverStone International has announced the completion of its acquisition of Irish insurance leader, Catalina Insurance Ireland

Hub International Limited (Hub), has officially acquired the assets of Ronald (Ron) Morin, Jr., operating under Morin Insurance Agency. The specific terms of the transaction remain undisclosed.

There has been a flurry of activity in the acquisitions space in the first weeks of 2024. Insurtech Insights looks at the first month of mergers in a buyers market.

Zurich Insurance Group has announced that Viridium Group won’t buy its life legacy business in Germany as planned.

Arthur J. Gallagher & Co. has announced the acquisition of Forest Insurance Facilities by its US wholesale brokerage, binding authority, and programmes division, Risk Placement Services, Inc. (RPS).

Allianz Direct, the European direct business arm of global insurance giant Allianz, has successfully acquired the home insurance business of online insurer Luko.

German insurtech Getsafe has successfully acquired deineStudienfinanzierung, a digital platform specialising in student loans.

Inszone Insurance has successfully acquired Jacque Pirtle Insurance, a well-established agency serving the Dallas/Fort Worth Metroplex for nearly three decades.

In the wake of a challenging year for mergers and acquisitions (M&A), global markets are gearing up for a significant rebound in 2024, according to recent findings from WTW’s Quarterly Deal Performance Monitor (QDPM).

HDI Global Specialty has acquired a majority stake in managing general agency (MGA) Falcon Risk Holdings and a subsidiary of Pennsylvania Lumbermens Mutual Insurance (PLM).

Verisk has announced the completed the acquisition of Rocket Enterprise Solutions GmbH, an insurtech provider based in Germany specialising in the property claims sector.

Pan-American Life Insurance Group (PALIG) has successfully concluded the acquisition and merger of Encova Life Insurance Company, marking a significant development in the realm of life, accident, and health insurance services.

Howden, the global insurance group, has solidified its position in the Norwegian market with the recent acquisition of Arctic Insurance AS, a rapidly growing insurance broker based in Oslo.

Aon Plc. a global leader in professional services, has unveiled plans to acquire NFP, a prominent middle-market provider offering comprehensive risk, benefits, wealth, and retirement plan advisory solutions.

Hub has announced the acquisition of AP Group, a comprehensive insurance agency specialising in coverage for dentists, oral surgeons, physicians, business professionals, and associations. Terms of the transaction were not disclosed.

In a move aimed at broadening its footprint in the Canadian market, insurtech firm Accelerant has announced the acquisition of Omega Insurance Holdings, Inc. from Till Capital Ltd.

In a shocking revelation, PhilHealth, the state health insurer of the Philippines, fell prey to a cyber attack due to the absence of cyber protection software, sparking urgent calls for a comprehensive cybersecurity audit.

Onsurity, a startup specialising in employee healthcare benefits, has successfully secured $24 million in its latest Series B funding round.

Arthur J. Gallagher & Co. has successfully completed the acquisition of The Coverage Pro, a prominent retail insurance broker specialising in construction for both commercial and personal lines clients across the state.

In a significant move to bolster its market presence, Getsafe, the innovative neo-insurer based in Germany, has successfully secured an agreement to acquire the German customer base of French insurtech company Luko.

Global Insurance Brokers (Global), one of the premier providers of risk management, insurance, and reinsurance broking services in India, has officially announced its acquisition by Aon plc.

MGT Partners has initiated the launch of MGT Insurance through the acquisition of CM Select from Church Mutual, a prominent insurer of religious organisations in the US.

Velocity HoldCo, LLC, and Insight Risk Technologies LLC have finalised an agreement that sees Velocity acquiring a majority stake in Insight Risk.

International specialist insurer Hiscox has entered into an agreement to sell DirectAsia, its business operations in Singapore and Thailand predominantly providing motor insurance, to boost Thailand Holdings Limited, the parent of the Roojai group of companies.

Leading British insurer Aviva has announced that it has reached an agreement to purchase the UK life insurance business of American International Group (AIG) for a substantial sum of £460 million (US$563 million).

Gallagher has revealed its plan to acquire Eastern Insurance Group, a subsidiary of Eastern Bank located in Natick, Massachusetts.

RiverStone International, the premier provider of legacy solutions in the Lloyd’s market, has inked a strategic agreement with members of the Catalina Group.

Howden-owned Aston Lark has announced the acquisition of Curtis Marine, a Plymouth-based marine insurance broker.

Marsh has announced its intent to acquire Honan Insurance Group, a distinguished insurance broker known for its proficiency in corporate risk, employee benefits, as well as strata and real estate insurance solutions.

Zurich Holding Company of America, a subsidiary of Zurich Insurance Group, has acquired SpearTip, a cyber counterintelligence firm that helps protect clients against cyber threats through proactive and response services.

While the industry buzzes about the potential impact of generative AI, Planck customers are already experiencing the benefits

Inszone Insurance Services has announced the acquisition of Speck Insurance and Financial Services.

Arthur J. Gallagher & Co has announced its latest acquisition of California-based Wigmore Insurance Agency, Inc.

Majesco, a global frontrunner in cloud insurance platform software, has declared the resounding success of its strategic acquisition of ClaimVantage in January 2021

Global reinsurer Hannover Re has showcased impressive growth in its H1 2023 financial results, recording a remarkable 3.9% surge in reinsurance revenue, which now stands at €12.3 billion.

Embedded insurance specialist, Cover Genius, has announced an exciting new partnership with Uber to offer enhanced protection for drivers in Brazil.

The State of Connecticut recently launched the Connecticut Baby Bond Trust with an initial deposit of $398 million, made possible in part by using a debt service reserve fund insurance policy from Build America Mutual (BAM).

DUAL, the prominent London-based managing general agent (MGA), has made a significant move by acquiring David Ashby Underwriting Ltd. (DAU), a specialised MGA focused on bloodstock and high-value sports horse insurance.

Ambac Financial Group, Inc. (NYSE: AMBC), a financial services holding company, has announced its acquisition of a majority stake in Riverton Insurance Agency Corp., a New Jersey-based insurance services business comprising a Managing General Agency (MGA) and a retail agency. The terms of the deal have not been disclosed.

Insurtech company Tractable, based in London, has secured $65 million in a Series E funding round led by SoftBank Vision Fund 2

Leading MGA, Nexus Underwriting, has successfully finalised its acquisition of Evolve Cyber Insurance Services LLC, an MGA based in California specialising in cyber insurance.

Despite the challenging market environment, insurtech startups are thriving. Insurtech Insights lists FIVE key players, with female founders and CEOs, that are driving change in the marketplace

NFP has finalised the purchase of FinTrust Insurance and Benefits’ employee benefits solutions business and Presidio Financial Services Corporation, marking the latest additions to its expanding portfolio of acquisitions.

Liberty Mutual Insurance and Generali Group have announced signing a definitive agreement for Generali to acquire Liberty Seguros, S.A. – Liberty Mutual’s personal lines and small commercial insurance business headquartered in Madrid.

Zurich Insurance Group (ZURN.S) is reportedly in talks to buy up to 51% of India’s Kotak General Insurance, two sources with direct knowledge of the matter have said, in a deal that would mark its first major bet on the fast-growing South Asian insurance market.

Guy Carpenter, a global risk and reinsurance specialist and a Marsh McLennan business, has announced the acquisition of Re Solutions, the leading independent reinsurance broker in Israel.

AIG has divested Validus Re to RenaissanceRe in an acquisition deal worth a reported $4.5 billion

Fisher Asset Management Reveals New Acquisition in Resideo Technologies, Inc. as reported to the Securities & Exchange Commission.

Zinnia, a leading life and annuity insurance technology and digital services company, announced today its acquisition of Policygenius, a digital insurance marketplace.

Boston-based insurtech startup Ledgebrook has successfully raised $4.6 million in a recent funding round led by Markd

Megan Kuczynski, President of Insurtech Insights USA has joined the Board of Advisors for the FinTech Graduate Program at University of Connecticut (UConn).

Direct Line Group, the private motor insurer, has acquired By Miles, a pay-by-mile insurance provider for an as yet, undisclosed sum.

Sproutt, the life insurance company that modernises life insurance for agencies, agents, and their customers, has announced the launch of Sproutt SmartLife for Agencies.

The insurtech space is changing rapidly – and incumbents and startups alike need to keep a watchful eye on the latest trends

Insurance group is the latest example of a long-established business trying out AI to improve productivity

Inszone Insurance Services has announced that it has acquired The Contractors Insurance Group, an Arizona-based agency that focuses on contractors.

Singapore-based insurtech bolt has partnered with Pathpoint, a digital wholesaler for small commercial excess & surplus (E&S).

Cover Genius, the insurtech for embedded protection, has announced the completion of an asset acquisition agreement with US-based embedded warranty provider, Clyde Technologies. The assets acquired will assist Cover Genius’ continued expansion into the medium-sized e-commerce segment.

Specialist Risk Group (SRG) has today announced its acquisition of the mid-market commercial broker Consort Insurance.

Insurance firm FWD Group Holdings Ltd (FWD.N) said on Monday it had agreed to buy a majority stake in Malaysian insurer Gibraltar BSN Life Bhd for an undisclosed price, expanding its presence in the country’s full-service insurance business.

Aviva has completed an £850 million buy-in of the Arcadia Group Pension Scheme and Arcadia Group Senior Executive Pension Scheme. The transaction enables the Trustees to secure benefits in excess of Pension Protection Fund levels for around 8,800 members of the schemes.

Aston Lark, a Howden company, today announces it has agreed terms to acquire Allegiance Insure Ltd. Based in the City of London, Allegiance Insure was established by Charles Wintour in 2015.

Financial services firm Brookfield Reinsurance announced it has entered a definitive agreement to acquire Argo Group International Holdings in an all-cash transaction valued at approximately $1.1 billion.

Merger offers access to Lloyd’s and worldwide markets as investors focus attention on forestry for carbon sequestration.

The investment arm of insurance giant Metlife Inc said on Tuesday it had agreed to acquire Raven Capital Management, a U.S. private credit manager with $2.1 billion in assets under management.

Essent Group agreed to purchase the title insurance subsidiaries of Finance of America’s Incenter business for $100 million, the latest company looking to find synergies between the two businesses.

UK-based Ardonagh Group has completed its acquisition of Envest, which it first agreed to acquire in November last year.

Westfield has announced that it has completed its acquisition of Lloyd’s of London Syndicate 1200 from Argo Group International Holdings.

Hub Financial Inc. (Hub Financial), one of Canada’s largest distributors of life insurance and investment solutions, announced today that it has acquired, through one of its affiliates, Achievex Financial Services Inc., W.C.S Financial Services Inc., W.C.S. Achievex Inc., Allen Wong & Associates Agency Limited, BridgeForce Financial Group Inc., Cinaber Financial Inc., Ontario East Insurance Agency Ltd., and Joseph B. Woodyatt Insurance Agencies Limited (BridgeForce). Terms of the transaction were not disclosed.

At-Bay, the insurance company for the digital age, today completed the acquisition of At-Bay Specialty Insurance Company, a Delaware-domiciled excess and surplus (E&S) lines property and casualty (P&C) insurer licensed in 44 states, from XL Insurance America, Inc.

The digital-first life insurance company builds on its initial successful launch with a carrier acquisition to expand nationally, bringing financial security to families with revolutionary new products and technology

Arthur J. Gallagher & Co. today announced that its subsidiary, Risk Placement Services, Inc. (RPS), has acquired Austin, Texas-based Remco Insurance Agencies, Inc. Terms of the transaction were not disclosed.

First Underwriting has launched a new motorsport insurance brand called Slipstream Underwriting.

Hub International has announced its acquisition of the assets of Michigan-based Grace & Porta Benefits, Inc.

Hub International Limited (Hub), a leading global insurance brokerage and financial services firm, announced today that it has acquired The O&S Insurance Brokerage Group, Inc. and OSA Insurance Brokerage Services, LLC (collectively, OSA Insurance Brokerage Services). Terms of the transaction were not

Marsh McLennan Agency (MMA), a subsidiary of Marsh, today announced the acquisition of Hunt Valley, Maryland-based HMS Insurance Associates, Inc., one of the nation’s largest independent agencies. Terms of the acquisition were not disclosed.

Strategic acquisition will add digital, out-of-the box payments capabilities to Duck Creek’s comprehensive suite of SaaS solutions for P&C and general insurers

The solution gives insurers better underwriting data, reduces fraudulent claims, and enhances protection for tradespeople in the U.K.

MagMutual Insurance Company, the nation’s largest mutual insurer of physicians, has completed its acquisition of MDAdvantage Insurance Company of New Jersey. The transaction received final corporate approval and regulatory approval by the New Jersey Department of Banking and Insurance in December.

Managing general agency Johnson & Johnson announced that it recently acquired the assets of Statewide Insurance Corp as it looks to expand into a number of Southwestern states.

Arthur J. Gallagher & Co. today announced the acquisition of Abilene, Texas-based CBS Insurance, LLP. Terms of the transaction were not disclosed.

Arthur J. Gallagher & Co. announced on Tuesday that it has agreed to acquire the partnership interests of Buck, a provider of retirement, HR and employee benefits consulting and administration services. The transaction is expected to close during the first half of 2023, subject to customary regulatory approvals.

Arthur J. Gallagher & Co. today announced the acquisition of Brisbane, Queensland-based Aviation Insurance Australia. Terms of the transaction were not disclosed.

Zurich Insurance Group AG has emerged as the front-runner to buy a majority stake in the Malaysian insurance business of US insurer MetLife Inc. and Kuala Lumpur-listed AMMB Holdings Bhd., according to people with knowledge of the matter.

Italian insurer Generali SpA is planning to sell roughly 20 billion euros ($21 billion) of its Italian life insurance portfolio, Bloomberg News reported on Wednesday, citing people familiar with the matter.

US insurer, Liberty Mutual Holding Company (LMHC), is exploring a sale of its businesses in Spain, Portugal and Ireland, according to Bloomberg News sources.

French insurance broker April Group said private equity firm KKR & Co. has become its new majority shareholder, according to a statement posted on its website.

Marsh McLennan Agency (MMA), a subsidiary of Marsh, today announced the acquisition of Focus Insurance, a leading personal insurance brokerage firm based in Houston, Texas. Terms of the acquisition were not disclosed.

Commercial insurance broker based in Tennessee, Bradley Insurance Agency, has been acquired by Marsh McLennan Agency (MMA), a subsidiary of Marsh. The terms of the acquisition have not been disclosed.

Aegon NV said on Thursday smaller rival ASR would acquire its insurance operations in the Netherlands in a deal that would see ASR replace it as the second-largest Dutch insurer.

Pet insurance company ManyPets announced the acquisition of Digital Edge Insurance Company, a US-based carrier, from Munich Re Digital Partners US Holding Corporation, following regulatory approval.

A new MGA has been launched in London a short distance from Lloyd’s market. Specialty MGA UK has been created with a focus on providing additional capacity for specialty lines of businesses and hard to place risks.

Gradient AI, a Boston-based enterprise software provider of AI solutions in the insurance industry, announced that it has acquired Prognos Health’s (New York) analytics business underwriting unit to leverage data from the company’s large collection of integrated medical records and lab data via its real-world data marketplace.

Allianz is expanding its automatic accident detection service. Dubbed the Allianz accident reporter, the digital claims service used by Allianz at the scene of an accident, can automatically detect accidents and notify the insurer. Insureds are later informed about the next steps of claims settlement.

Reinsurance giant Munich Re has acquired apinity GmbH, a start-up that supplies application programming interface (API) solutions in the form of Software-as-a-Service (SaaS) for the insurance industry’s ecosystem.

Allianz X, the digital investments arm of Allianz Group, will acquire 100 percent of the shares in simplesurance.

Singapore-based international insurtech, bolttech, has announced it has completed the acquisition of a majority shareholding in PT Axle Asia, an established insurance broker in Indonesia.

International insurance broker Howden, has acquired Swiss Broker, Born Consulting AG.

Gallagher has acquired AnotherDay, a specialist crisis and risk management consultancy that helps organisations to pre-empt and prepare for complex threats, react to crises and investigate criminality through the use of intelligence and technology.

Howden RE and TigerRisk have announced the creation of Howden Tiger SabRE (SabRE), a new group combining their MGA operations and programme capabilities.

Italy-headquartered insurer Generali has acquired Axa’s Malaysian operations, in line with Generali strategy to strengthen its leadership position in high potential markets.

On July 29, the day after the Metromile acquisition closed, Lemonade laid off 20% of the Metromile team, with the explanation: “This acquisition is synergistic, in that the combined entity is better than the sum of its parts, and can operate with fewer people than were needed to staff the two standalones.”

Toronto InsurTech startup Relay Platform has been acquired by At-Bay, a digital insurance provider based in San Francisco.

Coalition, a cyber insurtech, received regulatory approval to acquire Munich Re Digital Partners U.S. Holding Corporation’s Digital Affect Insurance Company, a P&C insurer licensed in 50 states.

Aviva has signed a binding agreement with the specialist managing general agent Azur Underwriting Ltd to acquire its high-net-worth personal lines business in the UK and Ireland.

Cover Genius, the insurtech for embedded insurance, announced today its acquisition of Booking Protect, the leading specialist in embedded ticket protection for ticket sellers, platforms and live event companies such as SeatGeek, Spectrix, AudienceView, and Night Out in the US, Zaiko in Japan, See Tickets, Festicket and TicketSource in the UK and OzTix in Australia.

Liberty Mutual Insurance has completed the acquisition of Malaysian insurer AmGeneral Insurance Berhad, which is expected to make Liberty Mutual the country’s largest auto insurer.

Cover Genius, the insurtech for embedded insurance, announced today its acquisition of Booking Protect, the leading specialist in embedded ticket protection for ticket sellers, platforms and live event companies.

American global insurance brokerage and risk management services acquires Australia’s National Insurance Group, extending their geographic reach.

InsurTech leader’s latest acquisition adds deep industry talent and two leading MGA solutions into the Vertafore ecosystem.

Gallagher announced recently that it has acquired INNOVU Group Holding Company Limited (“INNOVU Insurance”). Terms of the transaction were not disclosed.

Marsh McLennan Agency (MMA), a subsidiary of Marsh, today announced the acquisition of Clark Insurance, a leading independent agency in Maine. Terms of the acquisition were not disclosed.

Munich Re Life US, part of the global reinsurer, has signalled its intent to buy medical record firm Clareto.

Howden, the London-based international insurance broker, further strengthens its presence in Italy with two new acquisitions: Nord Est Insurance Broker and ASI Insurance Brokers.

Chubb has acquired the renewal rights of DUAL Asia’s financial lines portfolio in Hong Kong SAR and Singapore.

Hundreds of companies have said they are withdrawing or suspending operations in Russia after its invasion of Ukraine, from energy producer Shell Plc (SHEL.L) to carmaker Hyundai Motor Co (005380.KS) to PwC, a global professional services firm.

Slide, an insurtech startup that quickly raised $100 million in seed capital, has acquired $400 million worth of premiums from Orlando-based St. Johns Insurance Co., which recently ceased operations after a ratings agency downgraded it.

Hub will acquire the Insureon digital insurance agency and brand while Bold Penguin will acquire the Insureon technology platform.

The closing makes Liberty Mutual the second-largest carrier serving the independent agent channel.

Aon plc (NYSE: AON), a leading global professional services firm, today announced it has acquired actuarial software platform Tyche from technology and software firm RPC Tyche.

Trōv, one of the earliest and most widely recognized insurtechs, today announced that its technology has been acquired by The Travelers Companies, Inc. (NYSE: TRV), a leading provider of property casualty insurance for auto, home and business. Most members of Trōv’s team have also joined the company. Terms of the transaction were not disclosed.

Swiss Re has acquired the entire share capital of Champlain Reinsurance Company (CRC), a Swiss-based run-off reinsurance captive of Alcan Holdings Switzerland.

Bolttech, a Singapore-based insurtech unicorn, has acquired local insurance firm Ava Insurance for an undisclosed sum.

HSBC Insurance (Asia Pacific) Holdings, an indirect wholly-owned subsidiary of HSBC Holdings (HSBC), has completed the acquisition of 100% of the issued share capital of AXA Insurance Pte Limited (AXA Singapore) for a consideration of $529m, subject to closing adjustments.

The acquisition of the provider of AI-driven solutions advances CCC’s vision for straight-through processing across the claims lifecycle.

Here’s a round-up of January 2022’s insurance industry-related M&As and partnerships

Howden, the London-based insurance broker, has announced the acquisition of Tower SpA, a specialist insurance broker and risk advisory firm based in Vicenza, Italy.

French startup Luko is acquiring German startup Coya in order to grow its European presence and get an insurance license from German regulator. While Luko isn’t disclosing terms of the deal, the company says it’s a 100% share deal, which means that Coya investors are now Luko investors. Those investors include Valar Ventures, Headline and Roland Berger’s family office.

Swiss Re Corporate Solutions has acquired US-based independent ESL managing general underwriter (MGU) TMS Re for an undisclosed sum.

Beat Capital Partners, a long duration investor specialising in the insurance industry, has announced the sale of Tarian Underwriting to Corvus Insurance, a provider of smart commercial insurance products powered by AI-driven risk data.

Tampa-based HCI Group Inc. has agreed to buy United Insurance Holdings’ lines of business in three states.

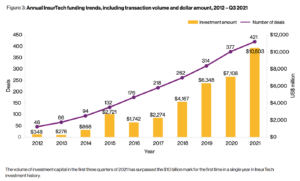

2021 has been a record year for insurtech funding. As of Q3 2021, more than US$10.5 billion had been raised by companies in the space year-to-date (YTD), surpassing 2020’s total of US$7.1 billion by nearly 48%, data from insurance advisory firm Willis Towers Watson show.

Pet health and insurtech company, Bought By Many, has acquired VetBox, a UK pet health subscription and fulfilment business, in a major step in the extension of its offering beyond insurance.

Zurich Insurance Group agreed to acquire Estonia-based company AlphaChat, which provides conversational artificial intelligence (AI) technology for customer service automation, to further enhance the group’s digital capabilities.

Kin, a leading direct-to-consumer homeowners insurance technology company, today announced it has completed the acquisition of an inactive insurance carrier that holds licenses in 43 states.

Willis Towers Watson has announced the acquisition of Aerosure, an aviation industry specialist, focused on the Australia, New Zealand and Pacific Island region.

Several insurtech companies including Hippo and Metromile, amongst others, have merged with a special purpose acquisition company (SPAC) as a path to being traded publicly on stock markets. This approach became more popular in the past two years, as the COVID-19 pandemic led to companies seeking quick, efficient paths to growth.

Milwaukee-based Insurance technology firm Zywave reports it has acquired Santa Barbara, Calif.-based ClarionDoor, a seller of insurance product distribution software for the property/casualty market.

Metromile’s auto insurance offerings are informed by a decade’s worth of data, which should improve the quality of the newly-introduced product, Lemonade Car.

Verisk Analytics, the global data analytics firm, has acquired North Carolina-based Data Driven Safety to expand its automobile insurance underwriting data business, Verisk announced.

Moody’s Corporation and RMS announced today that they have entered into a definitive agreement for Moody’s to acquire RMS, a leading global provider of climate and natural disaster risk modeling and analytics, for approximately $2.0 billion from Daily Mail and General Trust plc.

Willis Towers Watson has entered into an initial, non-binding agreement to acquire Leaderim, an insurance broking and consultancy business in Israel.

Insurance broker Willis Towers Watson (WTW) has signed a non-binding agreement to acquire Israel-based insurance broking and consultancy business Leaderim.

Pie Insurance will acquire a regional insurer as it moves forward with a bid of becoming a full-stack insurance carrier.

HazardHub’s risk API service, derived from comprehensive U.S. property and hazard data, enhances the power of the Guidewire Platform.

Global insurer AXA has entered into an agreement with HSBC Insurance (Asia-Pacific) Holdings Ltd over the sale of AXA Insurance Pte Ltd (AXA Singapore) for a total cash consideration of USD 575 million (€487mn).

Brookfield Asset Management Inc’s reinsurance unit has agreed to buy insurer American National Group Inc. for about $5.1 billion in an all-cash deal, the companies said on Monday.

Boston-based insurtech firm Corvus Insurance has announced the acquisition of Wingman Insurance, which provides a tech platform for cyber and tech E&O coverage across the US.

MGA Corvus Insurance, fresh off of raising $115 million in new venture financing, has made an acquisition with an eye on the admitted coverage marketplace and more digital platform partnerships. More acquisitions appear likely.

As a result of the business combination of CCC and SPAC Dragoneer Growth Opportuniteis, CCC Intelligent solutions Holdings Inc. will be listed on the NYSE as CCCS.

Insurance broker Willis Towers Watson PLC said on Tuesday it is weighing strategic alternatives for its reinsurance unit, Willis Re, days after a planned sale to rival Arthur J. Gallagher fell through.

Moody’s has entered into an agreement to acquire catastrophe risk modelling firm RMS for approximately $2.0 billion from Daily Mail and General Trust.

Zurich Insurance Group AG is nearing a deal to buy Deutsche Bank AG’s Italian financial promoters network, according to people familiar with the matter.

Chubb Limited (NYSE: CB) today announced that it has acquired the business of StreamLabs from Australia-based Reliance Worldwide Corporation Limited (RWC). StreamLabs offers leading Internet of Things (IoT) enabled water monitoring, leak detection and water shut-off products.

Home insurance group Hippo has completed its previously announced merger with Reinvent Technology Partners Z, a publicly traded special purpose acquisition company.

Aon Plc and Willis Towers Watson Plc called off their $30 billion merger plan on Monday, terminating an agreement that could have made the combined company the world’s largest insurance broker.

Insurance startup bolttech has purchased i-surance a B2B2C digital insurance platform, to accelerate its expansion in Europe.

American International Group Inc (AIG.N)plans to use an IPO to sell part of its life and retirement business, while Blackstone Group Inc (BX.N)agreed to buy a sizeable stake, according to a person familiar with the matter.

Global insurance and reinsurance brokers, Aon and Willis Towers Watson (WTW), have emphasised the pressing need for the “earliest possible trial date” for their pending case against the Antitrust Division of the U.S. Department of Justice (DoJ), which seeks to block their $30 billion combination.

Covéa, the French non-life mutual, is interested in acquiring AXA XL’s reinsurance business, AXA Re, in deal that could be valued at €5 billion, according to press reports.

WeSure is buying 50.4% of insurance company Ayalon’s shares at a $216 million valuation, 33% higher than its Tel Aviv Stock Exchange market cap.

Reports from Bloomberg highlight how the proposed $30 billion merger of insurance brokerage giants Aon and Willis Towers Watson (WTW) would create the world’s largest outsourced investment management firm.

Assicurazioni Generali has agreed to buy rival Axa’s insurance assets in Malaysia for a consideration of RM 1,290m (€262m) in a key strategic push into the region.

The enhanced ability to innovate is a principal motivator for Aon’s proposed acquisition of Aon and Willis Towers Watson. It’s a message that Aon CEO Greg Case has been emphasizing since the $30 billion deal was announced in March 2020.

The U.S. Justice Department filed a lawsuit on Wednesday aimed at stopping insurance broker Aon’s $30 billion acquisition of Willis Towers Watson because it would reduce competition and could lead to higher prices.

Cambridge Mobile Telematics (CMT), the global leader in mobile telematics and analytics, has acquired TrueMotion, the second largest mobile telematics provider.

Insurance broker Aon’s $30 billion bid for Willis Towers Watson, the biggest ever in the sector, is expected to get the EU antitrust green light later this month or in early July, people familiar with the matter said.

USAA is acquiring the insurtech Noblr and will use the company’s usage-based insurance platform for a new offering.

Insurance broker Aon said it will sell some assets to private equity firm Aquiline Capital Partners and tech firm Alight for $1.4 billion, in a bid to get U.S. Department of Justice approval for its merger with Willis Towers Watson.

Allstate has agreed to acquire Ohio-based SafeAuto, which offers car insurance that meets the minimum legal requirements in 28 states.

Berkshire Hathaway Inc said on Monday it has taken a $943 million stake in insurance brokerage Aon Plc and sold large portions of its investments in Chevron Corp and Wells Fargo & Co.

Anish Jadav has been appointed Chief Underwriting Officer for AXA XL P&C in the UK, life insurtech Ethos Technologies Inc. has a more than $2bn (£1.4bn) valuation after a $200m funding round, and home insurtech Kin has raised $63.9m in Series C funding.

The reinsurance industry is missing out on the benefits of digital transformation while the rest of the insurance industry surges ahead with modernisation, according to new research published by Supercede, the fast-growth global reinsurance placement platform.

The acquisition gives Insurity an advantage in pursuing the $40 billion program business market and enables P&C carriers and MGAs to rapidly grow through bureau content-enabled software.

Dieter Wemmer, a veteran insurance executive who was chief financial officer at Allianz SE, is launching a blank-check company to target deals in the sector where he worked for more than three decades, people familiar with the matter said.

Tokio Marine Holdings is reportedly acquiring a US-based insurer operating in the employee benefits space, in a deal that could be worth US$184 million.

Enquiron’s proven engagement success, data and technology solutions will complement Zywave’s existing product portfolio and help drive ROI for customers

Italy’s biggest insurer Generali is in exclusive talks to buy assets in Malaysia belonging to French rival AXA in a deal worth around 300 million euros ($358 million), two sources said on Tuesday.

Zurich Insurance and Farmers Exchanges have closed on buying MetLife’s U.S. property/casualty business for $3.94 billion.

The combination of the two companies reflects a shared vision: lowering costs and providing greater access to quality, affordable, personalized care, according to a press release issued by Cain Brothers, Zipnosis’ financial adviser.

Life and health insurance firm Bounce Life has sold its InsurTech platform and advisory business for an undisclosed seven-figure sum.

German re/insurer Allianz is exploring an offer for The Hartford, after the U.S. property and casualty insurer rejected a recent offer from Chubb, according to Bloomberg reports.

Aviva has sold its Polish operations to Germany’s Allianz for €2.5 billion in cash, completing a programme to sell European and Asian assets begun last year, the British insurer said on Friday.

Jakarta-based insurtech startup Qoala has acquired Thai peer FairDee, further expanding its reach in Southeast Asia. The company has a presence in Indonesia, Singapore, Malaysia, Vietnam, and now Thailand, serving millions of consumers across the region.

Canada’s Constellation Insurance Holdings, Inc. has agreed to acquire Cincinnati-based life and disability insurer Ohio National Mutual Holdings, Inc. and its wholly owned subsidiary Ohio National Financial Services, Inc. for a total consideration of US$1 billion.

Five years ago, Evan Greenberg led ACE’s nearly $30 billion acquisition of Chubb, morphing Chubb into its current status as a global property/casualty insurance giant he continues to guide as CEO. Now, the insurer is gunning for even larger size and reach with an offer to pay $23 billion for The Hartford, an industry icon with origins dating back to 1810.

Chubb Ltd., the global insurer led by Evan Greenberg, is exploring an acquisition of Hartford Financial Services Group Inc. in what could be one of the industry’s biggest deals in years, people familiar with the matter said.

Italy’s biggest insurer Generali is studying an acquisition in Russia worth nearly 2 billion euros ($2.4 billion), Il Sole 24 Ore daily reported on Wednesday.

Accelerant Holdings today announced the acquisition of Commonwealth Insurance Company of America from Brit Group, a subsidiary of Fairfax Financial.

Sightway Capital is selling its majority position in the multiline, tech-focused distributor, and will continue to hold a stake in the company as a minority shareholder.

Aviva Plc has exited its Italian businesses in a pair of deals totaling 873 million euros ($1.1 billion) as the UK insurer continues to pivot to its core markets.

Digital commercial insurance company Next Insurance has agreed to acquire AP Intego, a Massachusetts-based digital insurance agency providing small commercial insurance products.

After rumours began swirling that AXA XL was looking to sell its private client business to fellow insurance giant Aviva, the company has issued a statement to Insurance Business confirming its plans.

After months of speculation, London-headquartered insurer Aviva has announced an agreement to sell its French business to mutual insurer Aéma Groupe, for €3.2 billion in cash.

Aston Lark, the Chartered insurance broker backed by Goldman Sachs, further bolsters its employee benefits and individual health insurance expertise by today announcing it has agreed terms for the acquisition of both Right to Health Ltd and The Health Insurance Specialists. Both deals are expected to complete in early March.

Aviva Plc, the British insurer, is in advanced talks on a sale of its Italian operations as it pushes ahead with about 6 billion euros ($7.3 billion) of divestments, people with knowledge said.

British insurance giant Aviva is reportedly in advanced discussions regarding the sale of its Italian operations, as it continues to push ahead with around €6 billion (approx. AU$9.3 billion) of divestments.

The merger of Aon with Willis Towers Watson is on course to close in the first half of 2021, said John Haley, Willis Towers Watson’s Chief Executive.

Allianz will acquire full ownership of its China life insurance business after agreeing to buy the 49% stake it doesn’t already own in its Chinese joint venture, the German insurance giant said on Friday.

Insurtech startup CXA Group announced plans to restructure its business to focus “solely” on its enterprise software-as-a-service (SaaS) business.

The new owner-to-be: Sontiq, an identity security company with a number of identity and cyber monitoring products and services. Sontiq is a portfolio company of The Wicks Group of Companies, and it signed a definitive agreement to buy Cyberscout.

Mutual life insurer MassMutual has announced plans to acquire Great American Life Insurance Company from American Financial Group for $3.5 billion.

Allstate Corporation has entered an agreement to sell Allstate Life Insurance Company (ALIC) to Blackstone for almost $3 billion.

Canadian property and casualty insurer Intact gained shareholder approval for its proposed joint-takeover of UK insurer RSA.

Financial firm Sixth Street Partners has agreed to buy annuities company Talcott Resolution for $2 billion, the latest ownership change in a decade of frenzied industrywide life-insurance deal activity.

Property/casualty insurance companies far and wide are considering whether to develop technology platforms in-house or modernize some other way. Brown & Brown chose an acquisition to get there.

American Family Insurance’s holding company has acquired the small-commercial insurance distribution insurtech Bold Penguin, it announced.

In late November, Singapore-based digital life insurance company Singlife completed its US$2.3 billion merger with the Singapore arm of UK insurance company Aviva. The deal, which was first announced in September, was the largest insurance deal in Singapore and one of the largest in Southeast Asia, creating a new entity Aviva Singlife.

British used-car startup Cazoo has announced that it has agreed to acquire Drover , the UK’s leading car subscription platform, for an undisclosed sum.

Earlier this month, digital life insurance platform Bestow took a big step in expanding its carrier business nationwide by acquiring Centurion Life Insurance Company from Wells Fargo & Co.

Zurich Insurance’s subsidiary Farmers Group has agreed to team up with Farmers Exchanges to buy Metlife’s US property and casualty business for $3.94bn (£2.96bn).

Houston-based online commercial insurance portal Now Insurance Services announced that it has secured an additional $1.25 million in seed funding led by The MFO Group. The company has raised $2.5 million to date after its initial raise in 2019.

With world’s largest forum for insurance professionals, Insurtech Insights provides an invaluable platform for networking, new insights and exposure for thought leaders. We are always looking for new partners, content creators, and contributors to create value and deliver exceptional support to Insurtech Insights.

To share your knowledge, simply fill out the form.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |