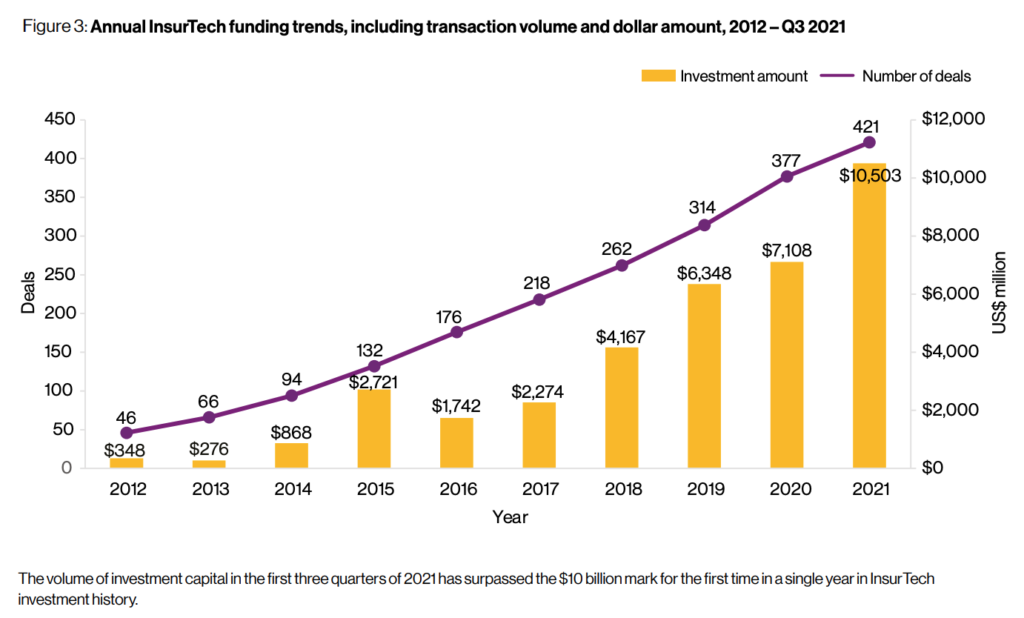

Global funding activity has been largely driven by mega-rounds of US$100 million and over, which amounted to a total of US$6 billion. Several of these mega-rounds took place in Asia-Pacific (APAC) where industry leaders in mature markets like India and China are closing massive late stage rounds ahead of public listings.

As the year comes to an end, we’ve compiled a list of the biggest insurtech funding rounds of 2021 in APAC.

Acko – US$255 million (India)

Indian insurance policy provider Acko reached unicorn status in October after raising US$255 million in a financing round. Acko develops and sells bite-sized auto insurance products, healthcare protections to employers, as well as protection on gadgets. The company covers millions of gig workers in the country through partnerships with companies including food delivery giants Swiggy and Zomato, and has amassed more than 70 million customers and around US$175 million in premiums.

Bolttech – US$210 million (Singapore)

Singapore-based Bolttech announced in September that it had raised US$210 million during a Series A fundraise which was then extended with an additional investment of US$37.2 million in December, bringing the total funds raised to US$247 million.

Bolttech provides a full suite of digital and data-driven capabilities, connecting insurers, distributors, and customers to make it easier and more efficient to buy and sell insurance and protection products. The company has built a global footprint that serves more than 7.7 million customers in 26 markets.

Digit Insurance – US$200 million (India)

Indian insurtech startup Digit Insurance raised US$200 million in July, taking the firm’s valuation to US$3.5 billion. Digit Insurance strives to make the process of getting cover, filing claims and payments easier using technology. It provides zero-touch claims enabled by audio claims, soft-copy document submission and full-time customer care assistance. The startup has over 20 million customers and processed approximately half a million claims.

Yuanbao – US$156 million (China)

Chinese insurtech startup Yuanbao unveiled in May that it had raised nearly 1 billion yuan (US$156 million) in its Series C funding round. Yuanbao uses big data and artificial intelligence (AI) technologies to match customers with suitable products from domestic insurance companies. The company also provides a one-stop shop for health management, insurance consultancy and smart underwriting while aiding the settlement of claims. It claims it has amassed millions of paying users since its inception only last year.

Paytm Insuretech – US$127 million (India)

India’s Paytm Insuretech, Paytm’s general insurance business, closed a US$127 million investment from Swiss Re in October. Paytm Insuretech plans to leverage Paytm’s customer base and merchant ecosystem to develop innovative insurance products and offer best-in-class digital solutions. Paytm, which specializes in digital payment systems, e-commerce and finance, entered the general insurance business last year through the acquisition of general insurance company Raheja QBE.

Carrot General Insurance – US$88.7 million (Korea)

South Korea’s first digital-only insurance provider Carrot General Insurance announced in July a 100 billion won (US$88.7 million) funding round. Carrot General Insurance is a full-stack digital-only general insurance company, providing pay-per-mile and usage-based auto coverage, e-commerce shipment coverage, mobile phone protection and other on-demand insurance products. The company, which hit 200,000 customers for its pay-per-mile auto insurance cover in less than two years since launching the product, plans to expand to Southeast Asia with local partners in the coming months.

PolicyBazaar – US$75 million (India)

Indian online insurance marketplace PolicyBazaar raised US$75 million in funding, its United Arab Emirates (UAE) and Middle East expansion plans. PolicyBazaar is an online platform that allows users to purchase life and general insurance. It features products from major firms in India, and claims more than 100 million visitors yearly and 400,000 sales each month. P PB Fintech, the parent company of PolicyBazaar and lending platform PaisaBazaar, began trading on the Bombay Stock Exchange in mid-November.

Cover Genius – US$72.8 million (Australia)

Cover Genius, a startup from Australia specialised in embedded insurance, raised in September a A$100 million (US$72.8 million) Series C funding round. Cover Genius provides end-to-end embedded insurance to the customers of some of the world’s largest digital companies, including Booking, eBay, Wayfair, Intuit, and Shopee. The funding round came on the back of strong growth during which the startup tripled it gross written premium (GWP) in the span of only six months.

Sunday – US$45 million (Thailand)

Sunday, a Thai insurtech startup, raised in September a US$45 million Series B funding round. Sunday is a full-stack insurtech company providing motor and travel insurance policies, healthcare coverage for employees and subscription-based smartphone plans through partners. The company uses AI and machine learning (ML) to underwrite its insurance products and automate pricing. It claims to serve 1.6 million customers and more than 700 enterprises, and plans to use the new capital injection to expand its portfolio in Thailand and Indonesia.

RenewBuy – US$45 million (India)

Indian insurtech company RenewBuy raised in June a US$45 million Series C funding round. Through its subsidiary D2C Insurance Broking Private, RenewBuy enables retail customers to buy moto, health and life insurance products through an end-to-end digital experience. The company claims it has about 50,000 point-of-sale person advisors and insures over 2.5 million customers.

Source: FintechNews