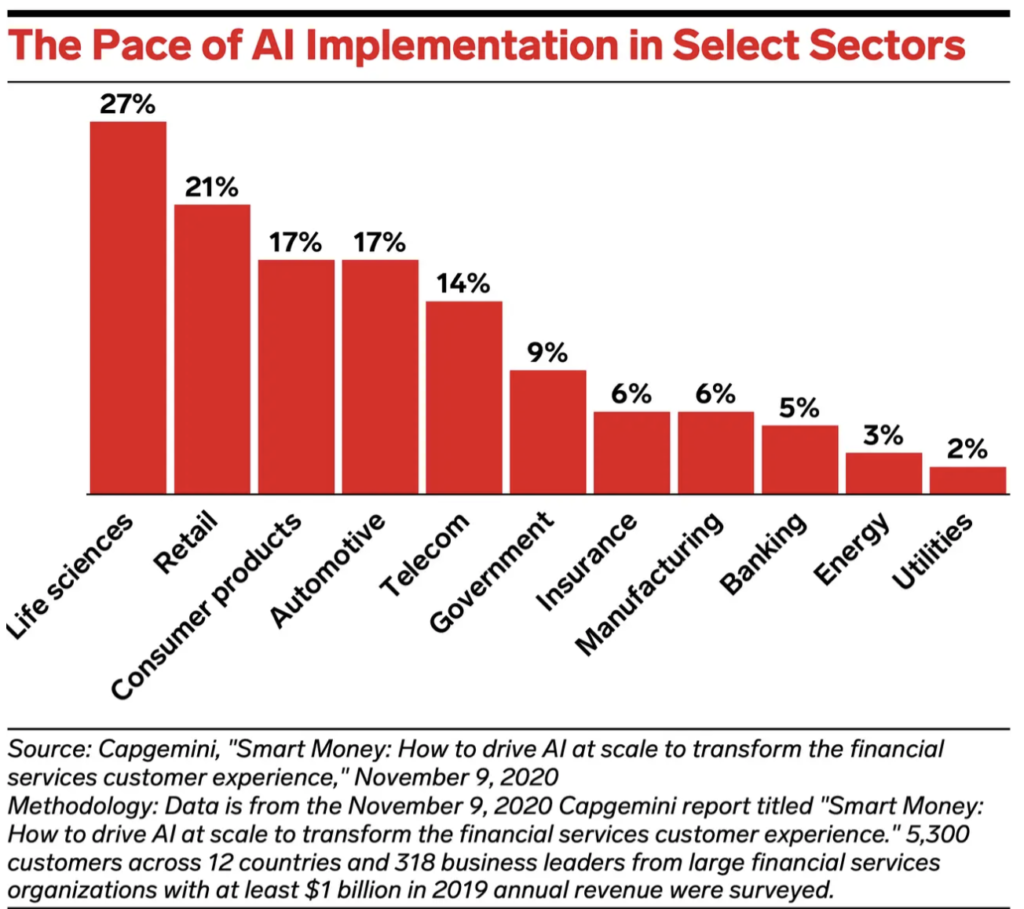

Insurers have lagged other sectors in implementing AI, leaving a gap for tech-centric firms, such as insurtechs and big techs, to disrupt the space.

In response, incumbent insurers are increasingly integrating AI across their front, middle, and back offices. Based on interviews with industry players, Insider Intelligence’s recent AI in Insurance report dives into key best practices for insurers looking to drive positive ROI from investments in AI innovations.

Here are three strategies currently in use by insurers that are finding success with AI applications:

1. Establish a clear roadmap to avoid getting trapped in costly pilots. Insurers’ risk-averse nature often leaves them hesitant to move solutions beyond the pilot stage, preferring instead to continue piloting a solution or wait for a peer to use it at scale. This cautious tendency is slowing the pace of AI innovation in the industry—but insurers can fight it by building clear, practical product roadmaps from the start, and sticking to pre-established plans and timelines from the earliest pilots to the final rollouts.

2. Tailor AI deployment to specific use cases to make data use more transparent and promote consumer trust. AI automation could result in the “black box” effect where a machine’s decision-making process is too opaque, eroding customers’ confidence in an insurer’s ability to provide fairly priced services. Insurers therefore must shine as bright a light as possible on how customer data is used to inform AI solutions’ decisions. They also should regularly review AI-powered outcomes to ensure they can be explainable and reasonable, and meet regulatory requirements, such as Europe’s GDPR.

3. Fill the technology skills gap that may be stymying AI initiatives. Incumbents are suffering from a tech talent shortage, which is expected to deepen as they increasingly embed tech into their processes. Here are two ways to fill the gap:

Upskill existing employees. Zurich UK, for example, is investing £1 million ($1.3 million) in training its 3,000-strong staff to use robotics, data science, and cybersecurity.

Build an innovative office culture to attract outside talent. Upskilling may not be a realistic solution to filling some technical roles. But insurers are at a disadvantage to insurtechs when it comes to attracting qualified candidates, because the latter are perceived as more technologically advanced.

To combat this reputation, insurers must nurture a culture that is more friendly to innovation by leaving behind legacy IT infrastructures and openly marketing modernization projects.

Source: Business Inider

Share this article: