What does it mean for motor insurers and EV customers?

The European electric vehicle (EV) market is experiencing unprecedented growth, with 2 million electric car sales in the first quarter of 2022, a rise of 75% compared to the same period in 2021. After a boom in 2020, EV sales also continue to rapidly gain momentum in Europe, accounting for 17% of Europe’s auto sales in 2021. Growth in the electric vehicles industry, not only in terms of size but also geography, comes with new risks and claims scenarios for car manufacturers, suppliers, insurers and drivers. In this article, we focus on the development of EVs in Europe. It’s also worth reading the recent publication, and interview with Scoring and Analytics expert Mobing Zhuang, that explore the New Energy Vehicles characteristics in China.

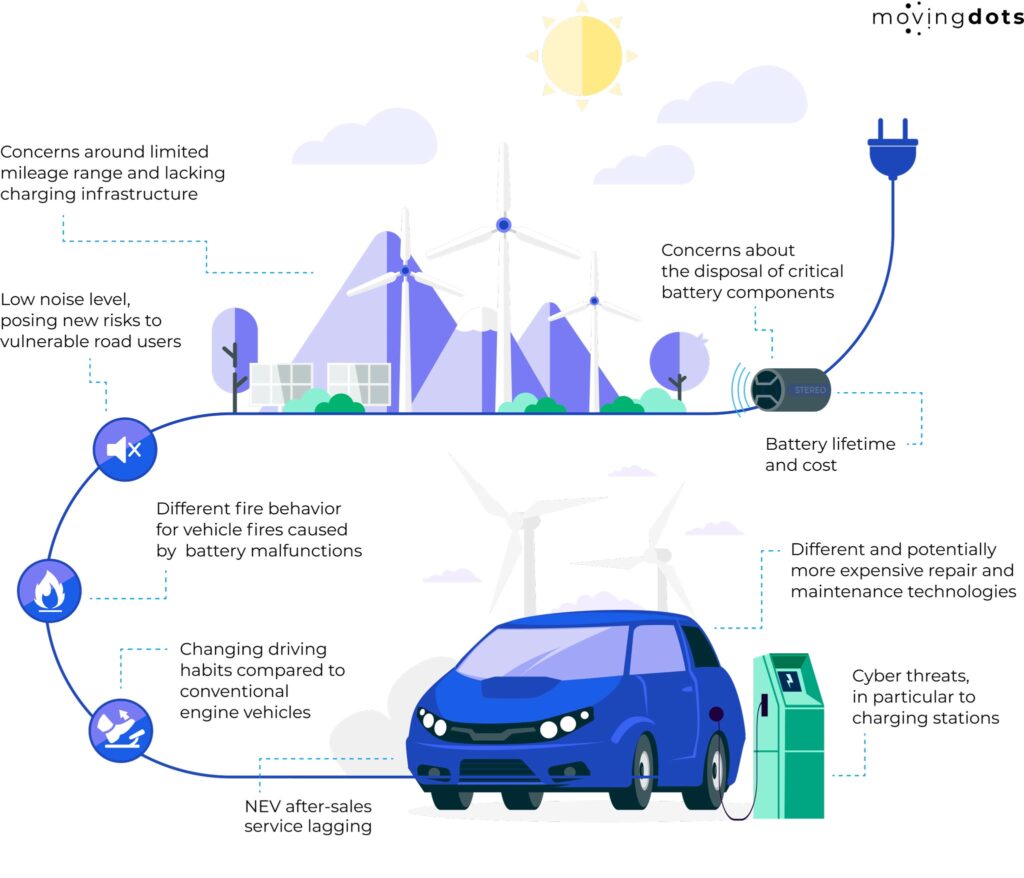

A different kind of risk

The take-up of EVs is expected to accelerate rapidly in the years to follow, driven by consumer demand and the urge for regulatory and societal changes. This introduces new threats, potentially more expensive repair costs and sustainability issues, all resulting in insurance implications and claims complexity.

Electromobility facts in the European Union

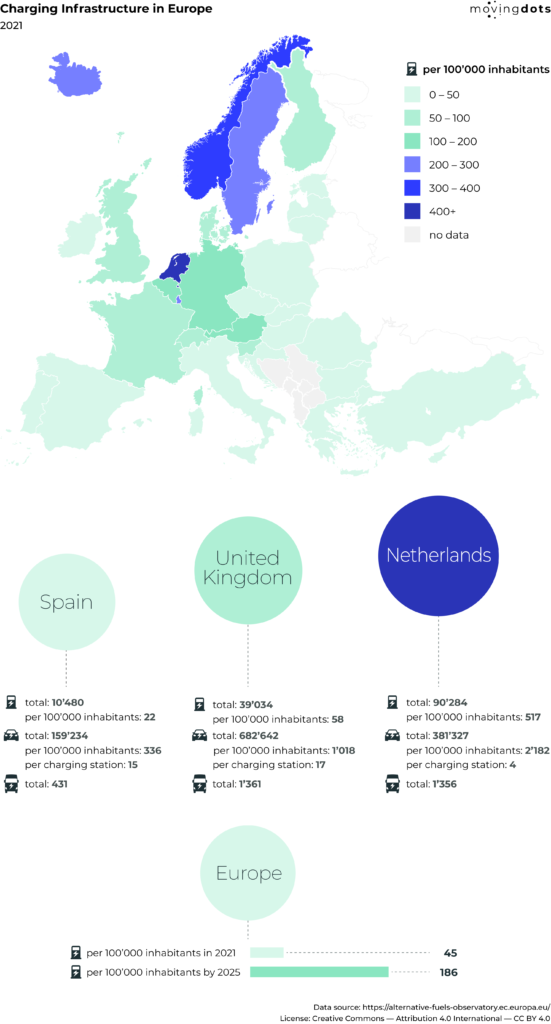

With the rapid rise of electric vehicles on the road, the roll-out of adequate charging infrastructure is also becoming increasingly urgent. According to studies by the International Energy Agency (IEA), the number of public charging stations has grown by 30% over the last year to a total of 300 000 slow chargers. The Netherlands leads in Europe with a 27% share of public charging stations, followed by France (17%), Germany (13%) and the United Kingdom (10%). Fast charging stations, which would enable longer trips and encourage consumers without access to private charging infrastructure to purchase EVs, are still much less common with a total of 50 000 units, half of which are in Germany, the United Kingdom and Norway. The following visualisation of data collected from the European Alternative Fuels Observatory website reveals how countries in Europe have advanced in terms of electromobility over the last decade.

The Swiss Re Electric Vehicles solution

Regulatory and societal changes and technical advancements impact motor markets globally. Under these circumstances, OEMs play a crucial role in this transition by creating safer and more reliable electric-powered vehicles. Insurers need to price new models in their portfolios and develop new insurance products targeted to customers’ needs. With the Swiss Re Electric Vehicles solution, we help mobility players achieve greater pricing transparency for EVs, create new insurance products and understand new vehicle trends.

The Swiss Re Electric Vehicles solution consists of:

- The Swiss Re EV Risk Score, which supports insurers in pricing EVs and their technical specificities more easily and accurately;

- Swiss Re Extended Warranty Insurance (EWI) for batteries, charging infrastructure and breakdown coverage.

Besides this, Swiss Re is offering technological / actuarial consulting (identifying immediate and prospective effects of EV technology on portfolio risks / economics). Swiss Re and Movingdots are working on a pay-as-you-drive (PAYD) insurance proposition which rewards and incentivises electric driving for (plug-in) hybrids, enabled through our telematics solution.

Authors: Omri Har-Shemesh, External consultant at Movingdots & Judith Wörle, Products & Partnerships Manager at Swiss Re