The independent agent space represents more than 30% of the industry’s total auto insurance sales, Metromile Inc. said in its announcement. The pay-per-mile digital auto insurer has made a “significant expansion” to its independent agent programs and expects to add to its rolls of more than 880 agents in the coming weeks.

Root Inc. said in its second-quarter stockholder letter that it was increasing its internal sales agent program and creating a pilot program to offer products through independent licensed agents. In explaining the move, Root said some customers “prefer a human element” when buying insurance.

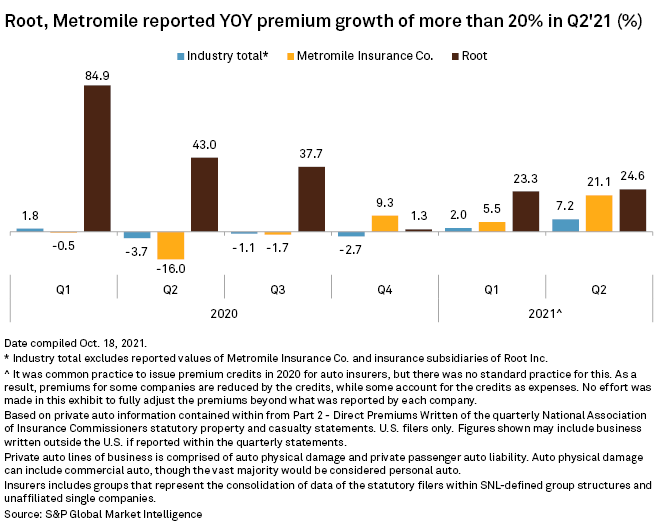

Broadening into more distribution channels, and the fact that driving habits in the U.S. are returning to pre-pandemic levels, could further boost the premium growth of both insurers. Both Metromile’s and Root’s private auto year-over-year direct premiums written rose by more than 20% during the second quarter, compared to a 7.2% gain for the industry.

Quarterly private auto direct premiums are comprised of auto physical damage and private passenger auto liability. Auto physical damage can include commercial auto, though the vast majority would be considered personal auto.

Root reported direct premiums of about $177 million during the second quarter within private auto, versus the $141.9 million in the prior-year period. For the first time ever it recorded direct premiums from the state of Wisconsin, logging almost $255,000 in the Dairy State. With the addition of Wisconsin, Root collected premiums across 31 states during the quarter, a review of regulatory filings shows.

Metromile’s direct premiums were $26.3 million in the second quarter, up from $21.7 million a year earlier and $25.9 million in the second quarter of 2019. Metromile’s geographic footprint did not expand in the most recent quarter; the company still underwrites business in only eight states, with California accounting for about 58% of its quarterly premiums. The insurer plans to file in new states by the end of the year. Troy Dye, senior vice president of growth, in an earnings call said the company will start with Indiana, Colorado, Missouri, Iowa and Texas.

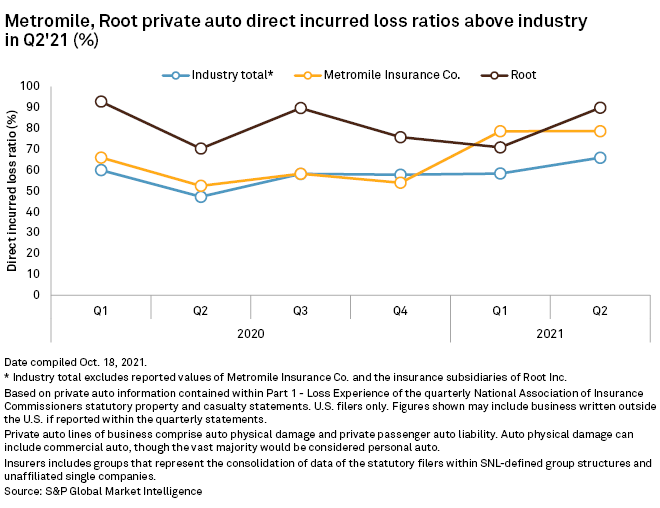

In line with their industry peers, direct incurred losses at the insurtechs are being impacted by elevated claims severity and frequency. Second-quarter direct incurred loss ratios came in at 89.9% and 78.7% for Root and Metromile, respectively. The aggregate industry total was about 66%.

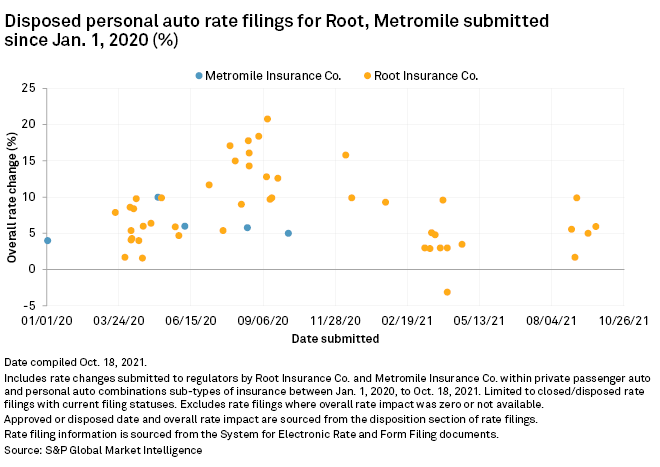

Root is taking action to deal to address rising losses by boosting auto rates. A review of rate filings collected by S&P Global Market Intelligence shows the company submitted and received approval for 15 rate changes thus far in 2021. Of those filings, 14 were seeking to hike rates. Those increases, as well as a single rate-decrease request, stand to push premiums higher by an aggregate $12.4 million.

The last rate filing disposed for Metromile was submitted to Virginia regulators on Oct. 5, 2020. The 5% rate increase went into effect in February 2021 for new business and in April 2021 for renewals.