To have happy customers in the world of insurance, the claims experience must be straightforward, as this is where you’ll find either satisfied customers or disgruntled ones who will look elsewhere for their insurance needs.

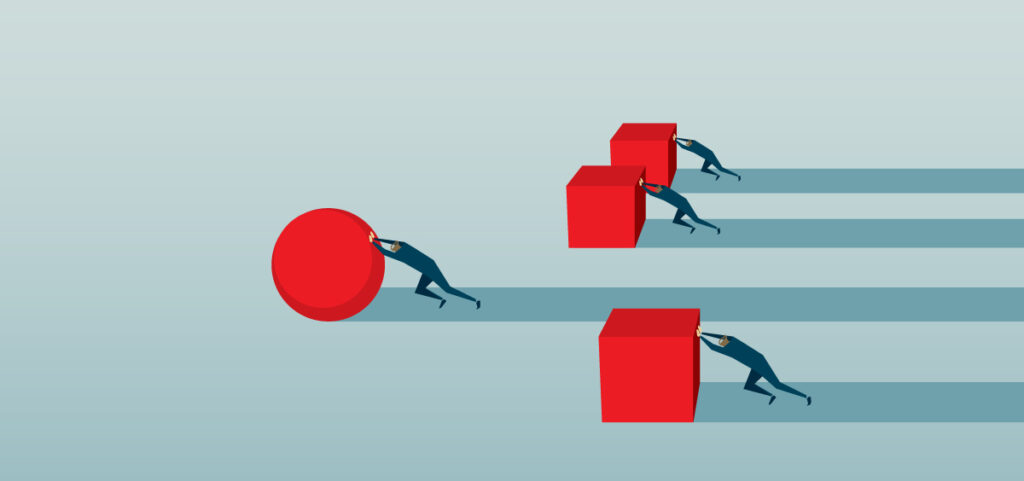

To ensure you both keep your current clients and gain new customers along the way, here are three ways for you to simplify your claims operations:

1. Communicate with your customers.

The number one thing that has to be done is to provide clear communication to your customers throughout the claims process. When it comes to insurance matters, there is typically a lot of stress for the said clients, as they are either dealing with a totaled car or a possible injury. Therefore, a lack of communication on your end can appear to be a lack of concern, and customers will notice.

There’s nothing worse than having to wait around for answers when dealing with a claim after experiencing a vehicular accident. With vehicle valuation services and programs, you can provide customers with straightforward answers about the value of their totaled vehicle. This can make it easier on your clients by keeping them in the loop.

Free Webinar: How to personalise insurance with dynamic policies

- What are some of the considerations and challenges when implementing dynamic policies?

- Are some customisations only possible with human expertise?

- Where are dynamic policies heading next?

2. Go online.

Gone are the days of snail mail. While you may still be sending out documents per policies in the company, insurance companies that use technology to communicate with customers and streamline their work are much more successful and trusted than those who do not. With technology all around us in this day and age, it’s wise to have online strategies that ensure you retain clients and keep them aware of the process and what’s going on.

Something to consider is the development of an app or the use of an already existing one designed to streamline all the documents, signing, and forms so that the loss of paper documents or the lack of a computer doesn’t affect the rapidity of the process. Additionally, an easy-to-use app ensures that all the information is provided for customers at their fingertips, so they don’t miss a thing.

3. Provide transparency during the claims process.

Customers dealing with claims are bound to want to know as much as possible throughout the process. Unfortunately, it can be a nerve-wracking time for them—and understandably so. One way to help provide transparency and the back and forth of documentation and information is to hire an outsourcing claims management partner. This can allow you to manage the clients you have more easily while providing them with the input they’re asking for, making it a more transparent and streamlined experience for everyone.

This also allows you to provide data when they ask for it and ensures that your company can manage a high level of clients, no matter what—because, after all, isn’t high customer retention and growth everything you’re aiming for anyway?

In Conclusion

Whether you go online or hire a company to help you with claims processing, there are solutions to your claim operation needs. Every insurance company knows that customer satisfaction is important, and if you want to make sure you’re hitting the mark with both current and prospective clients, you want things to be as streamlined as possible. Finding ways to simplify processes can make a world of difference in how quickly you can resolve claims, making for satisfied clients and a successful company.

Source: Your Money Geek