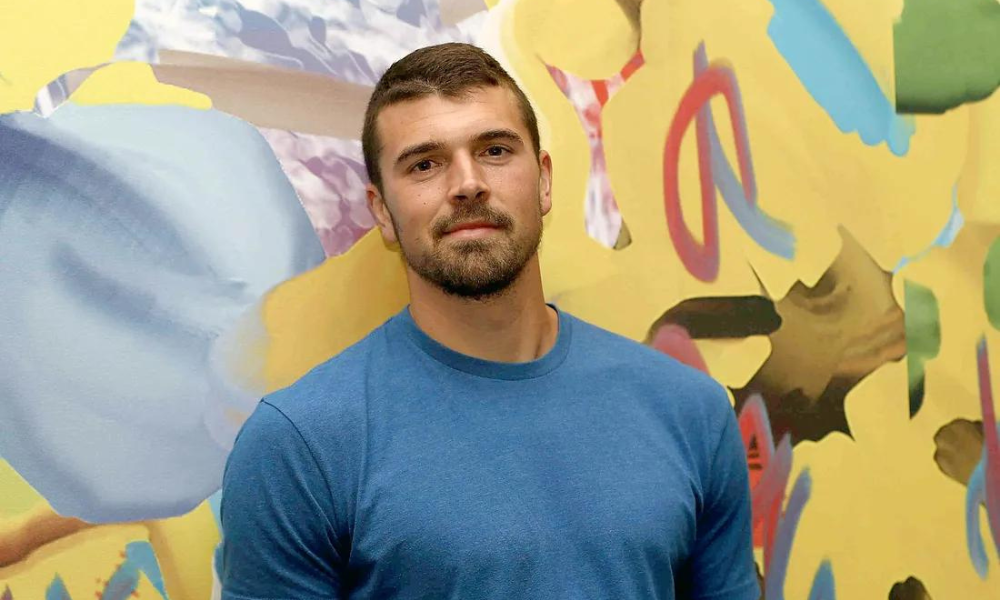

Founded in 2018 by CEO, David McFarland, along with fellow co-founders, Kevin Mackey, and Tim Metzner, Coterie is headquartered in Cincinnati, Ohio and provides bespoke small business insurance services.

Today, the insurtech is thriving, and has generated US$70 million in funding. But it hasn’t always been an easy journey. With investors withdrawing their support just prior to launch, and his third child due to arrive imminently, David says it was the unfailing support of his wife in self-funding the project that helped bring the company to fruition.

A dedicated family man who describes himself as a “recovering actuary” he is passionate about innovating in the insurance space, and prior to founding Coterie, he served as Chief Actuary and Head of Insurance Product & Pricing at Clearcover, a personal auto insurtech.

Ahead of his appearance at Insurtech Insights USA 2023, we caught up with him to find out more.

What attracted you to the insurance space? How did you become involved at the start of your career?

I was a history major until I found mathematics in my junior year of college. I didn’t know what an actuary was at the time, all I knew was that I loved solving problems. After a semester of studying math, I decided to take the actuarial exams and the rest is history.

You moved from an industry role, to a startup – Clearcover – to your own launch of Coterie. What drove you towards entrepreneurship? Was there an ‘aha’ moment?

The aha moment was at the start of my career, when I was working as an actuary for the National Council on Compensation Insurance (NCCI). NCCI handles the workers comp reporting and loss/costs for around 40 states or so. I was amazed at the lack of efficiency and accuracy of reporting.

I remember driving with my wife who was my girlfriend at the time and telling her, “I need to start an insurance company. We could automate data collection and underwriting and bring more value to everyone in the space.” After that, I took opportunity after opportunity to keep learning new things – generally moving from higher-paying jobs to lower paying jobs just to gain more experience.

What were your biggest challenges in launching Coterie – and which solutions proved most successful?

Challenges are a part of doing anything extraordinary. I mean that in the true sense of the word, i.e., things that are beyond the ordinary. Getting started is always tough. When it was just me getting things started, I had a few investors who seemed really bullish on what we were doing.

At the time, my wife was in her third trimester with our third child. We were moving to Cincinnati and I was going to leave my great job at a well-funded insurtech to start something completely new in a city where we knew exactly two people. I remember being at a going-away party for my family when my investor called. He said he loved what we were doing but had just one recommendation – that we just re-sell other carriers’ products. That we don’t try and make anything new since it was too risky. Instead, be a digital broker.

While I think digital brokers bring value to space, it wasn’t what my vision was. I explained this as tactfully as I could, and he tactfully told me that they wouldn’t invest. We agreed to disagree, and I then explained to my wife that we were going to be doing this without any money or financial support. She, always the trooper, said, “I’m good with that.”

After moving to Cincinnati, I found an amazing team who were willing to get to work before I signed our first term sheet. The night I signed that first term sheet, my wife went into labour and the next morning gave birth to our third child, John.

It’s a tough time for insurtech startups – with less funding available, and many companies initiating job cuts. What’s your strategy in terms of keeping the company moving in the right direction?

We’re in a fortunate position right now. No one knows the future so I don’t want to say that it will be great forever. Thankfully, we’re growing, while keeping our loss ratio low. Further, we have a commercial lines book with minimal property and CAT exposure, making it attractive. The goal right now is to continue to improve steadily and make smart decisions. We have something good going and are not looking to get greedy. Accordingly, we’re generally practicing underwriting discipline while automating where we can and increasing efficiencies across the company. Super un-sexy work, but that’s generally what you do when you’re building a company.

Coterie Insurance specialises in innovating embedded products in the P&C space. What are your main differentiators among your market competitors?

We focus on speed, simplicity, and service. Our API is super easy to use. We can integrate anywhere and require minimal data to quote and bind. The speed at which our partners can quote and bind is practically instantaneous.

Further, our appetite is built for partnerships, so we go fairly broad, enabling us to service a large portion of our partners.

If you could fix one problem in the insurance space with a click of your fingers – what would it be and why?

Fraud. Fraud is one of the biggest detriments to everyone in the value chain. It’s robbing the agents, the policyholders, and the insurers, but the policyholders are the ones who are hurting most. It accounts for 20 percent of the premium. If we didn’t have fraud, that savings would be passed onto the policyholders, saving them tons of money across all lines.

How do you see the future of embedded products unfolding – and are there any new innovations that Coterie is due to launch that we should know about?

It depends on the line of business. There are some that are currently delivering on the embedded side today. Most aren’t. Some may never. In order to achieve this, you need to be able to meet the customer at a point of relevance, which is not the same as a point of sale.

We need to find or create that moment where insurance is relevant to them and capitalise on it, delivering value to the customer when they need it. I don’t think we’re close to that in most lines, but there are a few that have figured it out. As far as business insurance goes, there are some places where this will work, but you also need to have systems to integrate insurance with. Right now, everyone is focused on cutting headcount and gaining efficiency. Ancillary revenue isn’t as relevant.

What inspires you in insurtech today?

Aside what we’re doing at Coterie by helping the 32 million small businesses in the US along with the agents and brokers serving them, the advances in crop insurance are particularly interesting, especially when I consider the application to stabilising the economies of impoverished communities. We often forget how much easier our lives are with insurance. It removes a significant amount of volatility. Through insurance, we can reduce risk and help impoverished communities grow all over the world, especially with the advancements in crop/agriculture that we’re seeing today.

Join Coterie at Insurtech Insights USA 2023

To find out more about Coterie’s latest strategies and innovations, join David McFarland at Insurtech Insights USA 2023 on June 7th and 8th, at the Javits Center in New York. He will be taking part in the expert panel session: “Balancing Art and Science: The Bionic Approach Transforming Underwriting Capabilities”

To find out more, click here