The round was co-led by Insight Partners and Canapi Ventures with participation from Sequoia, Accel and Gaingels. Co-founder and CEO Kyle Mack said that the new capital will enable Middesk to triple its headcount to 120 employees by 2023 and further develop products in the identity management space.

“When people hear ‘identity,’ they think of ‘identity verification,’ but identity means something different based on who is asking or interested,” Mack told TechCrunch in an email interview. “For a bank, it means simplifying the process of opening commercial bank accounts. For a lender, it means accelerating the process for businesses to access capital. For the government, it means ensuring businesses are registered and paying their taxes appropriately.”

Mack co-launched Middesk in 2019 with Kurt Ruppel to address what he describes as the “downstream effects and resulting challenges of onboarding new business customers.” Mack previously worked at Checkr, where he managed and built the solution consulting team. Ruppel was a senior software engineer at Zendesk before joining Checkr, where he worked with Mack as an engineering manager.

“When entrepreneurs start a business, they’ll need a bank account and credit card within weeks of forming the company. Within months, they’ll need access to working capital and insurance, payments and payroll providers to grow the business. We take for granted how easy it is for a person to access a financial product made possible through strong infrastructure products. Businesses don’t have this,” Mack said.

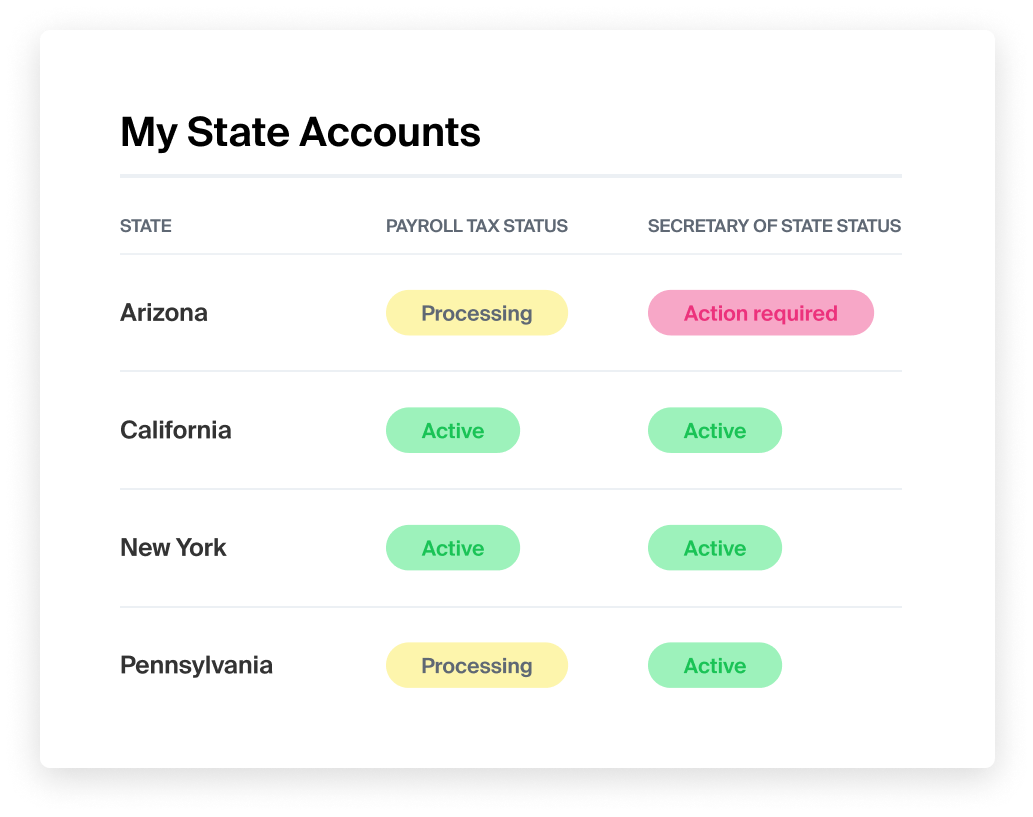

Companies can see their compliance status from Middesk’s dashboard. Image Credits: Middesk

Middesk’s “identity-as-a-service” APIs can be used by banks, insurers, credit card companies, lenders, payment firms, payroll companies and other service providers to automate onboarding in regulated industries, specifically for business customers. Middesk provides data on businesses in the U.S. and notifies service providers of changes to its customer base, enabling them to make decisions during and after onboarding.

According to Mack, Middesk allows service providers to form a picture of their customers and offer products they might need to establish, operate and maintain their businesses. It also helps companies manage their business by setting up payroll tax accounts, registering with the U.S. Secretary of State and managing government communications.

Source: TechCrunch