By this stage, insurers can certainly be forgiven for casting a relieved glance in the rear-view mirror, as 2020’s trail of carnage slowly recedes from view. But, tempting as it is to push into 2021 looking backwards, we must not take our eyes off the road ahead.

Taking stock of Covid-19

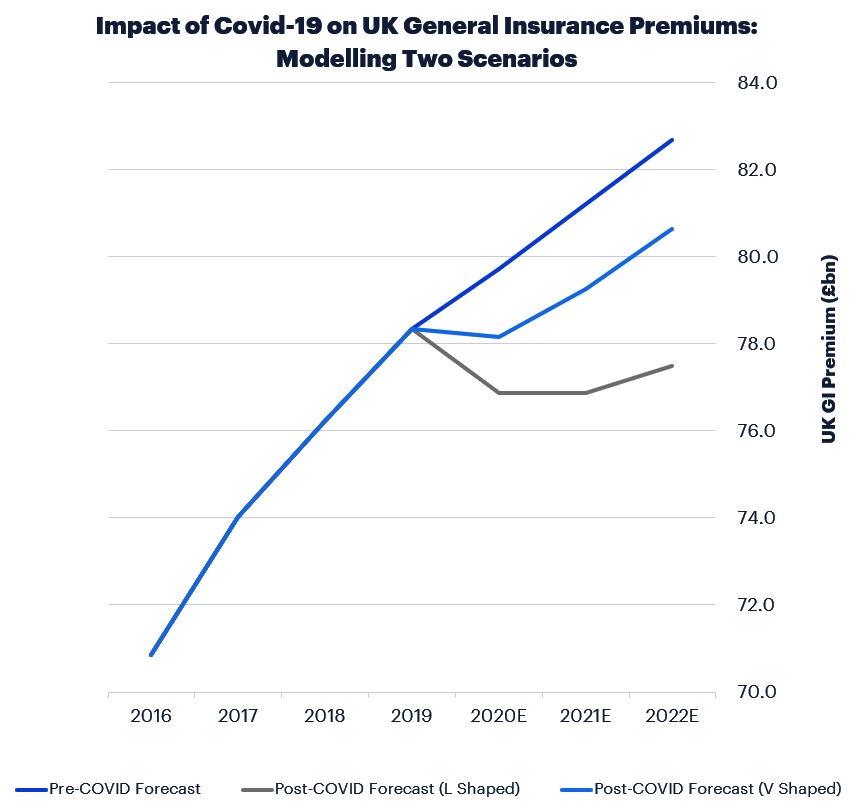

The direct impact of the pandemic on insurance is by now clear, both for the top and bottom line. Accenture Research estimates between £2bn and £3bn in “missing” GI premium during 2020 in the UK alone, with up to £5bn missing by 2022, depending on whether we see a “V-shaped” recovery (best case) or an L-shaped recovery (worst case). Meanwhile, the Association of British Insurers (ABI) expects COVID-19 to cost UK carriers £1.8bn in claims.

But, for all that direct costs from COVID-19 have been large, they are not the full picture. The coming years could bring a further cost – an opportunity cost – if insurers choose to look back on 2020 as an aberration, instead of recognising the ways in which the pandemic has changed the game for good.

New year, new normal, new competitive dynamic

So, what does this new normal look like for insurers? Well, let’s start with consumers… The pandemic has melted the ice caps of digital apathy once and for all, hastening even the most old-school buyers into the Amazon age.

Consumers are simultaneously cash-strapped and fixated on their financial future – and more willing than ever to wield the hammer on bad customer service. Elsewhere, policy documents and their many obscurities have become a daily concern for business owners great and small.

All this brings a new competitive dynamic into play, and insurers slow to embrace this within their lines of business risk losing market share to better-attuned competitors. This is insurers’ time – but never have the shortcomings of the industry been so apparent to so many.

With the pandemic still ongoing, insurers have plenty to do to keep the wheels on the road. But their long-term planning cannot be about restoring themselves to 2019 condition. The next stretch will require more than a change of tires and a fresh lick of paint. In many ways, insurers must become a different kind of vehicle entirely if they are to stay in – and win – the race.

Exploring the new normal across insurance lines

Implications vary substantially by line, and insurers will need to match their New Normal strategy to their business mix. Differences are most pronounced between Personal and Commercial:

Personal lines continue to experience commoditisation, pushing carriers not just to reduce operational costs but also to look for new pockets of growth outside the core business.

For commercial insurers, the pandemic has inflicted heavy losses, creating attractive hard-market opportunities in many areas as well as a heightened sense of societal mission – especially with regard to the small and medium-sized businesses (SMBs) that form the backbone of the UK economy.

Source: Accenture