“The fact that hype exists doesn’t prove that something is not important.”- V. S. Ramachandran

You’d be excused for not believing the hype around embedded insurance distribution. It’s on the lips of every insurtech pundit (with praise or loathing) and there’s no shortage of people and companies eager to proclaim themselves the new authority. But for all of that noise, embedded distribution hasn’t materially changed much about how insurance works. Yet.

I suppose I was/am one of those self-proclaimed experts too. I stood on my soapbox in 2016 with a blog about the transformation of insurance distribution. Back then we called it “incidental insurance,” which turned out to be the right direction, just the wrong branding. “Embedded” sounds cooler.

That article outlined how integrating insurance into “moments of relevance” increases motivation by making the customer aware of beneficial purchasing opportunities and improves ability by lowering friction and improving user experiences. The increase in motivation and ability then leads to the desired behavior – more effective and efficient insurance purchasing.

However, since that article was published in 2016 embedded insurance hasn’t generated much real traction. Sure, in the last 18 months the talk has been there. But the walk? Not so much. Why is that? I have a theory, and it has to do with what I didn’t know in 2016.

Ability Comes from Confidence, not Timing.

Back then, I believed the act of embedding insurance would not only capitalize on moments of motivation, but also necessarily improve ability, leading to more effective selling. But it turns out that wasn’t true, at least not for everyone.

Yes, embedding insurance does access temporary spikes in motivation to make the product more relevant. But here’s what I missed – wrapping the sale in a cool, fast user experience doesn’t materially improve ability for large groups of consumers. Instead, to really improve ability, you have to ensure the customer feels confident during that moment of relevance.

As we built Clearcover Insurance Company, we realized and codified the four things we believe every customer wants from their insurance experience – we call it our Customer Confidence Loop. Those things are:

● Transparency – Am I getting reliable and complete information?

● Convenience – Is this easy and fast enough for me?

● Affordability – Am I paying as little as reasonably possible to meet my needs?

● Value – Am I getting maximum value for my money?

Each of the items on this list matters; but as you might guess from the associated questions, they matter differently (in definition and relative importance) to different customers, or for different products. This has serious implications on strategy.

For example, when we launched Clearcover I underestimated how important agents are for auto insurance customers. Agents deliver what we’ve come to call “curated value.” They work on the customer’s behalf to gather information, source options, curate a selection process and validate choices. This gives the customer confidence they are seeing their real options (transparency), getting a good price (affordability), and getting the right coverage (value), all while doing less work themselves (convenience).

But I didn’t see this at first. So we focused on selecting a channel (i.e. direct) vs. identifying how channels deliver confidence and how that might shape our strategy. Even having blogged about a fancy behavioral model, instead of using real customer preferences to understand and improve ability to purchase, I allowed preconceived notions to drive a myopic distribution focus. And that held us back… until we realized that one size doesn’t fit all when it comes to building the confidence that powers a great sales experience.

I think many people are making the same mistake with embedded insurance today.

Embedded Insurance is a Strategy, Not a Channel.

To date, embedded insurance has generated a lot of hype as a novel distribution channel for an insurance carrier. But embedded is a strategy – not a channel. It is a tool to deliver on the customer confidence loop, but it’s not necessarily constrained by channels. So if your definition of embedded insurance is limited to integration, quoting and binding of a single insurance product, you’re not seeing the whole picture.

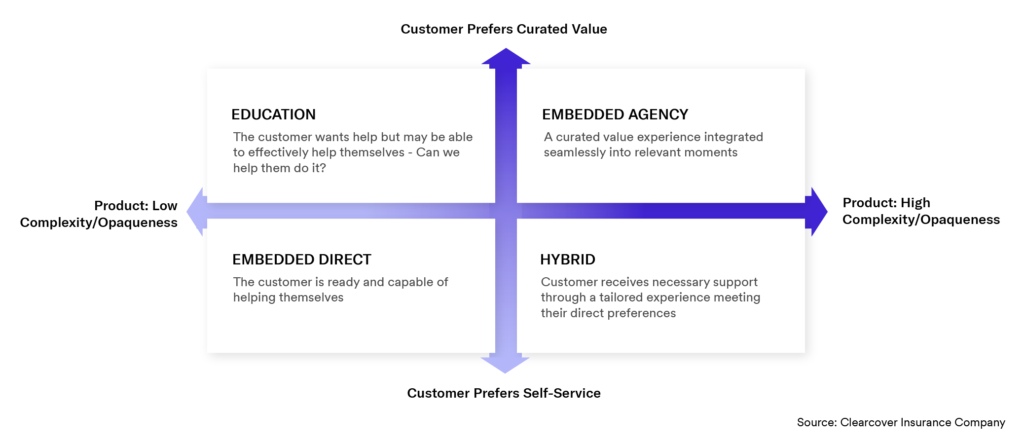

There are key differences between how you might deploy an “embedded strategy” based on the customer and type of product in question. For example, if your customer prefers a

“curated value” experience and is buying a product they don’t understand, an integrated single product quote and bind experience won’t help them much, no matter how great it looks.

Here’s one way we think about it. The 2×2 below has a y-axis representing customer preference (prefers self-service vs. curated value) and an x-axis that distinguishes between product complexity/opaqueness (which creates personal risk via incorrect coverage, being undercovered, etc.).

Using this framework, it becomes clear there are a variety of ways to think about executing an embedded strategy. For some customers and products, “Embedded Direct” – a direct integration of a single quote and bind experience, which seems to be the embedded definition most commonly used in the market today – works. For many others, it does not. You may need to integrate an agency experience to fully deliver customer confidence. Or even find a balance/hybrid of direct and agency approaches. The key is that, for embedded insurance to really work, one-channel does not fit all.

Reality: One Approach to Embedded Doesn’t Fit All

For our market – personal lines – I believe the implications this has on embedded strategy are obvious. Personal lines products, while structurally similar across companies, are still complex for consumers and can be costly if you self-serve incorrectly. And there are a litany of options out there. This is why more than 70% of personal lines premium goes through agents. So if you want to better serve the market by integrating insurance in relevant moments, then you have to consider that while some people value fast and easy, many people also want support, guidance, and curated value. This is why the best outcomes will be driven by companies that make Embedded Agency and Hybrid part of their overall strategy – not just Embedded Direct.

For companies in a different market, or with different customers and products, the strategy might be completely different. That’s the point. As the people driving embedded insurance into the future, our job is to find the right approach to building confident customers, so that ability can increase alongside motivation.

So is embedded insurance hype, or real? I guess it depends on your strategy. If you think integration and data alone are enough to make it happen – like I did in 2016 – then you might be stuck at hype. If you’re willing to adopt a more channel-agnostic and customer-centric strategy, and build the technology and operations to support it, then you might just have something real.