Peter Ohnemus’ passion for data, health and wellbeing, is disrupting the health and wellbeing space. The Zurich-based businessman and father-of-five is a self-confessed technocrat who launched dacadoo – a company that develops technology solutions for digital health engagement upstream and health risk quantification downstream, in 2010.

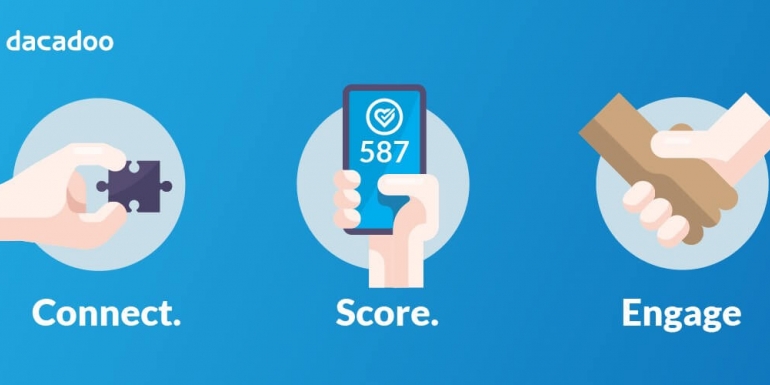

dacadoo provides an API-driven holistic Health Score between 1 and 1000, that enables insurance companies to build a range of wellbeing indicators into their assessments, including mental health, physical health, pharmacy services and blood testing, to name a few. dacadoo is now operational in 40 countries, is available in 18 different languages, serving millions of customers globally.

From sustainability to lifestyle

The idea came to Ohnemus following a sustainability programme he worked on with his previous in-company position as President and CEO of ASSET4. He explains, “I created a sustainability rating solution – and I thought if I could get a sustainability rating of a publicly quoted company looking at their energy usage, water usage and so on, I could do the same for human life.”

According to Ohnemus, there are over 325,000 health apps available, proving that the desire to monitor and track wellbeing is in high demand globally. But rather than take on the mainstream marketplace, dacadoo provides the digital health engagement technology that other companies can build on.

They are global partners with Accenture, the world’s biggest system integrator, Aon, UnitedHealth Group, and Apple – to name a few.

A passion for wellbeing and healthcare

Ohnemus is a firm advocate of data and how it is transforming the life and health insurance space. But he’s also humanitarian-driven, and is keen to contribute to improving health on a global scale. He believes fundamentally that modern society is damaging health as we are sitting too much and consuming too much processed food with lots of sugar, fat and salt. His biggest concern involves the explosion of chronic diseases such as diabetes, high blood pressure, cancer that are exacerbated by poor life choices.

“I tell my kids that when I grew up, we had no dishwasher and we had a black and white TV. We also walk anywhere from 30 to 60% less than we did 40 years ago. That causes disease, because we were born to walk. We evolved to be active and we need oxygen in our lungs. Lifestyle changes are literally life-changing.”

Ohnemus points out that depending on the country, health insurance providers spend anywhere from 65 to 80% on chronic diseases. “Mark Andreeson, the very famous venture capitalist, said, ‘software is eating the world’. And I say chronic diseases are eating the insurance world,” he says.

History has also played its role, transforming the dietary and lifestyle habits of entire western populations. The transformation of family roles in recent decades has contributed to more health problems, he says. “In the sixties, we put the whole family into work. Both men and women joined the working market. It was then that we started relying on convenience foods, making frozen pizzas and hotdogs and so on. Fast food production lacks healthy nutrition, and has contributed significantly to chronic disease numbers. We have to be honest with ourselves, that if you can keep a pizza for three to four years frozen in your freezer, you can only imagine what happens in your stomach. And this is directly the fault of the industrialisation of society and wealth creation.”

He continues: “I tell my kids that when I grew up, we had no dishwasher and we had a black and white TV. We also walk anywhere from 30 to 60% less than we did 40 years ago. That causes disease, because we were born to walk. We evolved to be active and we need oxygen in our lungs. Lifestyle changes are literally life-changing.”

Despite his passion for health and wellness, Ohnemus is no fitness guru. He enjoys the good things in life, and encourages his family to do the same. But, he also wants people to be aware of the aspects that could give them better health and therefore, a better quality of life. “I’m not a skinny guy or a priest, I’m just saying that we, we have to live better, we have to look after ourselves better, and obesity, diabetes, lower back pain and mental health problems are very significant issues for today’s society. Ultimately, that’s why I founded dacadoo. I wanted to make a difference.”

Creating useful, accessible health risk data

Quantifying all the lifestyle and physical variables in an algorithmic format that realistically reflects a person’s genuine health state, also needs to be universally accessible. “To provide a baseline Health Score that anyone can understand, you can normalise it into a number that makes sense on a braid scale. My motivation has always been to help people understand where they are standing compared to the rest of society, and how they can improve their health.”

“IBM says we only use 3% of all healthcare data globally. So I think that’s pretty fundamental. If an insurance company understands the risk, they can price the risk. We created a baseline and a system that can help people navigate health

Improving price points for customers was also a motivation for Ohnemus. “IBM says we only use 3% of all healthcare data globally. So I think that’s pretty fundamental. If an insurance company understands the risk, they can price the risk. We created a baseline and a system that can help people navigate health – and we now call this lifestyle navigation.”

CB Insights is a big advocate of dacadoo’s offering, and through their market research, it soon became clear that the platform was the global leader for its Health Risk Engine, which scores both mortality and morbidity in real time. dacadoo’s technology stack solution is now considered the North Star score in health terms.

“Depending on your age, lifestyle, medical history, mental wellbeing and situation in life, you are given a number, or score, between one to 1000. And if you are one, you are going to leave this beautiful planet, and if you score a thousand, you’re a superhero,” Ohnemus explains.

Health is a marathon, not a sprint

He makes it sound simple, but in reality, it was anything but (health being a marathon and not a sprint). Ohnemus and his team spent seven years developing dacadoo’s API – and he fully admits that task was far from easy. In fact, it presented far more challenges than he’d anticipated.

Recalling those early days, he says, “I never thought it would take so long for digital health to become mainstream or mission critical, but as a direct and open entrepreneur, it definitely took longer than we expected, to build the platform and to realise its potential.”

Despite his previous business experiences, Ohnemus describes the process as “complicated” – and not from a technology standpoint, but from a regulatory one. “As you know, the insurance industry is a highly regulatory space. The first generations of the consumer devices were not super exact and if you want to create a medical, underwritable product for the insurance companies, it’s important to have good health data points. We had a lot of noise on the AI and machining models in the beginning. We had to scrap a lot of data to really find the goodies in the haystack.”

Building trust and innovation adoption in the insurance industry

But to get to this point, dacadoo’s platform went through multiple testing procedures to hone its solution, and to build its recognition. “We did a lot of work in the beginning for hospitals where we were scoring outcome-based models. We worked for the military. We worked for the police. We worked for transportation associations, and then slowly but surely we started getting acceptance in the insurance industry.”

Given that the insurance industry is often accused of not embracing change as quickly as other industries, Ohnemus’s experience is almost certainly not a unique one. Indeed, many leading innovators struggle to establish themselves in the space.

This is hardly surprising, given insurance companies in certain sectors are traditionally averse to risk taking even though they underwrite risk. Breaking into the healthcare space brings additional complications, he says, because “healthcare is one of the most conservative industries you can find.”

Navigating challenges and agility

Understandably, the pandemic was a cause for concern for Ohnemus, who was in the midst of experiencing dacadoo’s potential when Covid hit. He experienced the frustration of the younger generation first hand, as his own children struggled to adjust to lockdown restrictions – and there was his company to consider too.

I think for any entrepreneur to break in and get to the level where we are at today, with millions of consumers using our Health Score and our Lifestyle Navigation system, is a bigger undertaking, and achievement that I could ever have imagined in my wildest dreams.”

“You know, in the middle of Covid, I was like, where are we going with this? My daughters wanted to meet with their friends and be back at university. It was frustrating and alarming as well from a business point of view.”

But like most digitally adept companies, the transition to work from home was easier than he’d imagined – and its time that Ohnemus looks back upon with pride. “I’m really proud that our team, during that period, was capable of doing some major client wins and projects. For example, we managed a corporation agreement with HSBC, we launched it in Hong Kong, and we did the whole implementation during Covid, remotely of course, when we were 10,000 kilometres away from the site.”

Another example is a project dacadoo worked on with Albertsons – the world’s third largest supermarket chain that is more commonly known as Safeway. Albertsons’ leadership team realised during Covid, that the future of retail was a lot more about #WeCare, sustainability, inclusiveness, and understanding the consumers’ health. “They built Albertsons Sincerely Health with us, and now they are rolling it out to their plus 60 million US consumers,” he says.

These positive experiences have boosted the company’s agility and resilience – and ultimately made it a stronger proposition.

Indeed, dacadoo is a massive success story – and is far bigger today than Ohnemus ever deemed possible.

He concludes: “I think for any entrepreneur to break in and get to the level where we are at today, with millions of consumers using our Health Score and our Lifestyle Navigation system, is a bigger undertaking, and achievement that I could ever have imagined in my wildest dreams. It is very satisfactory to try to help people have a healthier and a happy life.”