A comprehensive cloud strategy enables insurers to reach not one but three key business objectives. It will accelerate growth, drive digital transformation, and also curb costs.

A comprehensive cloud strategy enables insurers to reach not one but three key business objectives. It will accelerate growth, drive digital transformation, and also curb costs.

All too often insurers settle for just one of these goals. It’s usually cost control. But they miss the big picture. They underestimate how scaling up their cloud services can transform their businesses and deliver benefits across their organizations. Before pushing ahead with their current cloud agendas, insurers should stop and check that they’re on track to get the most benefit from their service providers.

Missed opportunities can lead to disappointment. Our research shows that two-thirds of the organizations that have ventured into the cloud have not achieved the benefits they expected.

Sure, the savings that cloud services can deliver are often substantial. But cloud initiatives are most likely to succeed when they charted within a well-defined long-term technology and business strategy.

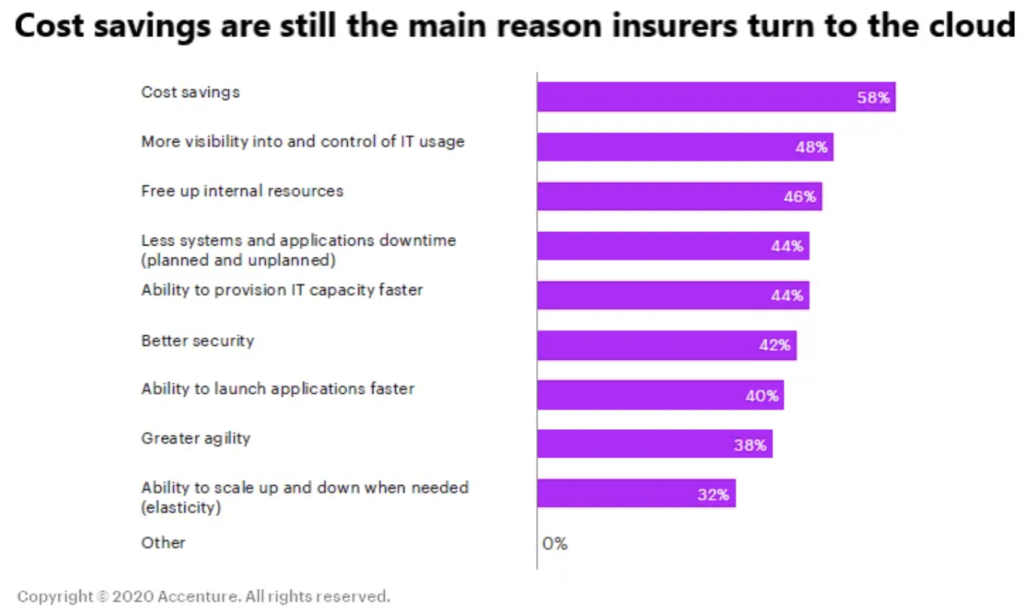

The cloud is giving some insurers substantial cost savings.

We found that nearly 60 percent of insurers identify cost savings as a key benefit of cloud computing. It’s well ahead of other advantages such as the quick provision of IT resources (44 percent), greater agility (38 percent) and the capability to scale technology applications and resources (32 percent).

According to our research, some insurers are enjoying substantial cost savings since moving to the cloud. They’ve achieved combined ratios well below 95 percent and expense ratios of around 20 percent. These levels are far ahead of the industry averages for either P&C or life insurers. Furthermore, these industry leaders have been able to use their savings to shift some of their technology spending from maintenance to innovation. They’ve cut their “run” costs, for example, from 75 percent of their IT budgets to 65 percent while pushing up spending on “change” initiatives from 25 percent to 35 percent.

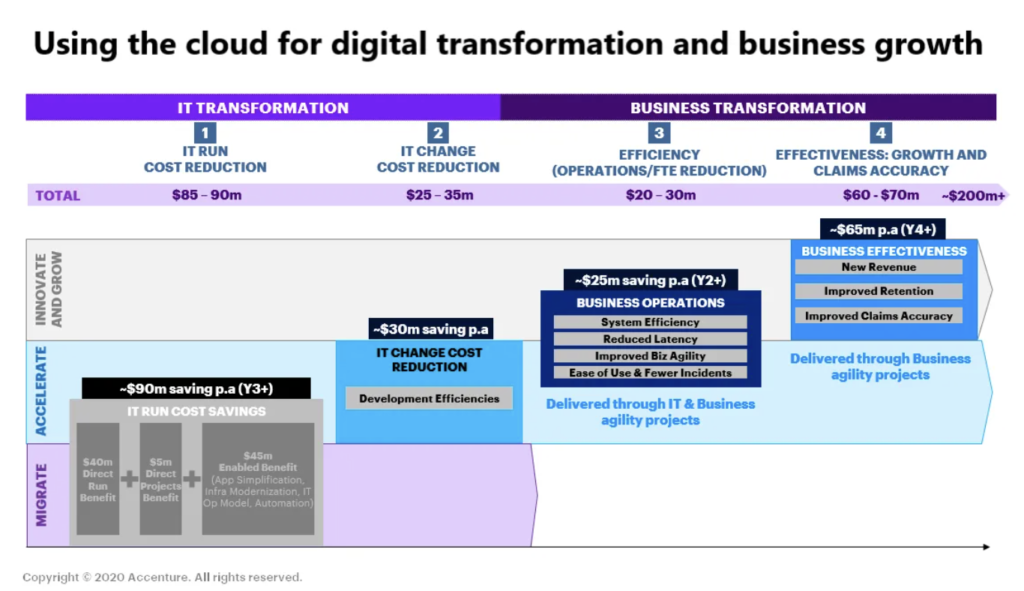

These benefits are impressive. But when combined with cloud-based initiatives to drive growth and accelerate digital transformation they can become spectacular. Insurers that shift their key applications and critical workloads to the cloud can reduce their technology expenditure and improve spending controls. At the same time, they can also use the on-demand capabilities of cloud services to modernize their operations and develop strategic growth initiatives. The illustration below shows how a global insurer is using the cloud to go far beyond just cost savings. The company is also reaping the benefits of rapid digital transformation and aggressive business growth.

The cloud can deliver significant operations improvements.

Cloud services can drive new business growth.

Source: Accenture

Reserv Named to Forbes Fintech 50 for Claims Technology Innovation

Reserv, a leading claims and claims technology provider, has been recognized in the 2026 Forbes Fintech 50, marking a significant milestone for the company. Out of 50 companies on the list, Reserv is one of only five in the insurance sector and the sole firm focused specifically on claims and claims infrastructure.

CRC Group Completes Acquisition of Euclid Transactional to Expand Specialty Capabilities

CRC Group has completed the acquisition of Euclid Transactional from private investment firm Searchlight Capital Partners, expanding its capabilities in financial and professional lines underwriting. Financial terms of the transaction were not disclosed.

Andrew McGee Named Chief Broking Officer for Howden UK&I Retail

Global insurance and reinsurance broker Howden has appointed Andrew McGee as Chief Broking Officer for its UK & Ireland (UK&I) Retail division, strengthening its leadership team as the firm continues to expand its retail operations.