Fitch forecasts significant growth in pension risk transfers as the post-pandemic recovery in pension scheme funding levels makes it more affordable for corporates to offload their pension liabilities to insurers.

Elsewhere in Europe, life sector outlooks are neutral, with the positives, such as favourable new business trends, broadly in balance with the negatives, such as still-low investment yields.

Demand to transfer pension risk comes from companies no longer willing to bear the financial risk associated with defined-benefit staff pension schemes. Such schemes were once common in the UK (more so than elsewhere in Europe) and, although most are closed to new entrants and future accruals, their liabilities are a significant burden, with funding levels under pressure from low bond yields and increasing life expectancy.

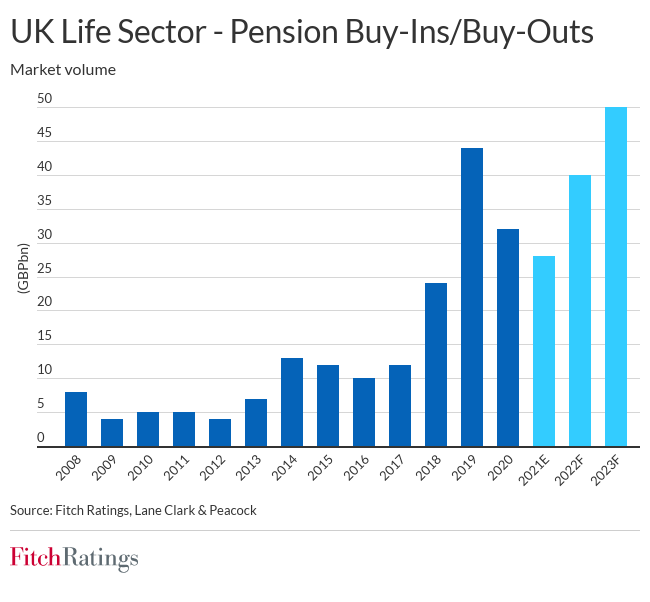

Companies transfer pension risks to insurers under buy-ins (where, in return for an upfront premium, the insurer makes payments to the scheme to cover future pension amounts) and buy-outs (where the insurer makes all pension payments directly to scheme members). Volumes of buy-ins and buy-outs declined in 2020 and 2021, which we attribute to the negative impact of pandemic-induced financial market volatility in 2020 on funding levels and confidence to transact. The transaction timeframe, from initiation to conclusion, is typically nine to 12 months.

Volumes are likely to recover strongly in 2022 and 2023, underpinned by strong structural demand. Rising bond yields would support the trend as they would improve funding levels and affordability. We expect the market to grow for another five years, with volumes peaking around 2026. However, volumes may be lumpy from one year to the next given the large size of some deals.

The UK life sector’s improving outlook is also supported by increasing inflows into unit-linked funds, largely driven by the growth in workplace retirement savings schemes. We expect net inflows to continue increasing in 2022, supported by the economic recovery, despite pressure on some households’ disposable income from high inflation.

Strong inflows into savings products are also a theme in several other European life sectors, including in France and Italy (unit-linked products) and Germany (hybrid products with limited investment guarantees). French life insurers have seen record unit-linked net inflows following their strategic initiatives in recent years to reduce their reliance on traditional, capital-intensive savings products. This has helped to safeguard their credit profiles from the effects of ultra-low interest rates.

Ten-year government bond yields in the UK and the eurozone have risen in recent weeks. They are still near historical lows, but if they continue to increase on market expectations of policy rate rises to counter inflation, life insurers could start to benefit. Higher bond yields generally enable life insurers to earn higher interest margins on the premium income and maturing asset proceeds they invest to back their policyholder liabilities, which increases their profitability.

Fitch’s 2022 Insurance Insights Series, which runs throughout 1Q22, includes sessions on the UK and other major European insurance markets, IFRS 17, cyber risk and sustainable finance. Past sessions are available on demand. To access the series, please click here.