Insurance companies can substantially improve the benefits they gain from cloud computing if they align their business needs with the products and services offered by big cloud providers.

Some technologies are critical to insurers but bring cloud providers little extra revenue.

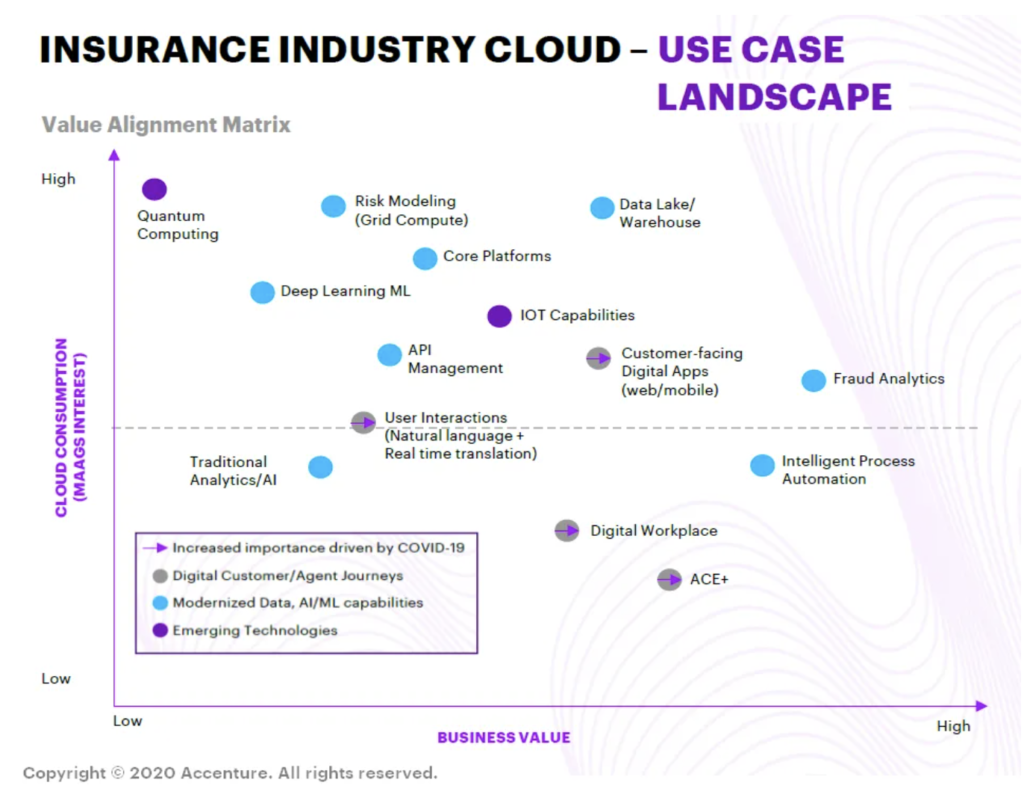

This value-alignment matrix is a broad guide. It maps the current and expected needs of insurers against the average cloud consumption requirements of users of Microsoft, Amazon, Alibaba, and Google’s (MAAG’s) cloud services. Each of these cloud service providers has a wide product set. The features and pricing of offerings, such as Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS), can vary considerably. Insurers should look carefully at the products and services offered by each of the major cloud providers and align themselves with the companies that will best serve them now and in the future.

Migrate, accelerate, grow—as businesses progress along typical cloud journeys, business value can be amplified if it is defined and actively pursued.

Business benefits are often overshadowed by the search for cost savings.

A business-driven cloud agenda is a big change from the way insurers have tended to view the cloud in the past. Cost savings, as I mentioned in my previous blog post [Link], are the most common motive for insurers moving to the cloud. Better control and management of technology resources come next. Business benefits, such as greater agility or the ability to scale new services or applications, rank much lower.

A business-driven agenda requires insurers to manage three key steps as they journey further into the cloud.

Migrate: Migrating infrastructure and software to the cloud reduces IT operating costs and the “technology debt” caused by inefficient legacy systems, and provides users with scalability on demand.

Accelerate: By building on robust cloud infrastructure, insurers can accelerate technology enhancements and speed up business efficiency improvements. Quick gains include service center enhancements, reduced administrative reworking, and less IT down time.

Innovate and Grow: Platform solutions allow insurers to hasten business improvements and enhance risk management. A variety of proven solutions, which continue to be upgraded, are available for applications such as claims processing, product distribution, and business development.

Technology improvements and cost control are important components of any cloud agenda. But they should never overshadow the business benefits of cloud migration.

Post-VIP Roundtable Thoughts: Unpacking the (false) paradox of efficiency vs experience trade offs in insurance by Rory Yates

By Rory Yates: To discuss and debate this topic we ran a wonderful Insurtech Insights session with Amazon Business in their London HQ, and there was a stellar line up debating this topic, and I was honored to moderate it.

Zurich Strengthens Its Fraud Defences with Quantexa Real-Time AI, Connecting Industry-Wide Claims Data

Zurich Insurance is increasing the power of its real-time fraud detection by becoming the first insurer to partner with Quantexa in the UK.

Allianz Joins The Spark as Member; Sirma Boshnakova Appointed to Global Advisory Board

The Spark, the world’s first Global Prevention Lab, has announced that Allianz has joined as a member, with Sirma Boshnakova, Member of the Board of Management of Allianz SE, appointed to The Spark’s Global Advisory Board. This collaboration represents a major step forward in the insurance industry’s shift towards prevention-first strategies and measurable, sustainable impact.