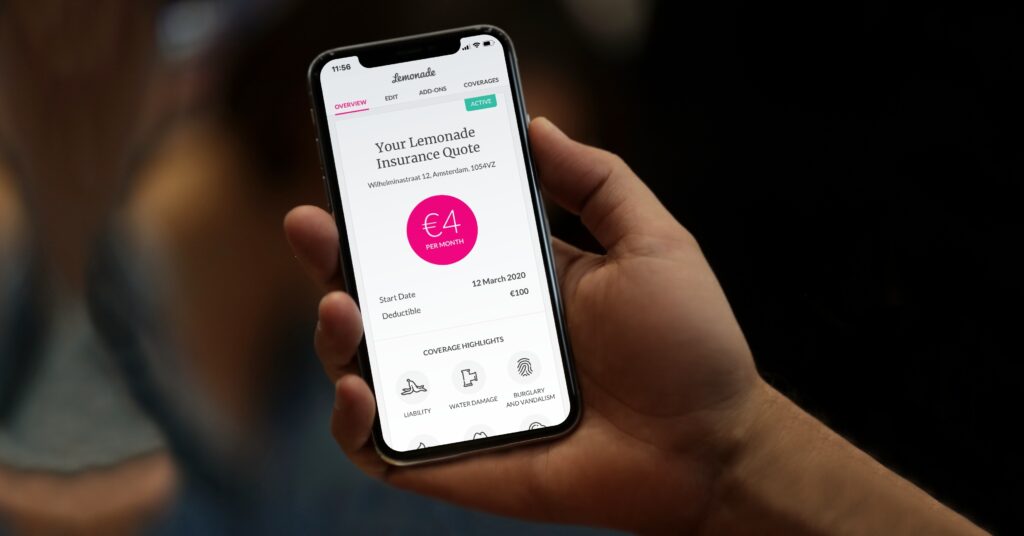

Lemonade took the No. 1 spot for the renters insurance segment in the J.D. Power 2020 U.S. Home Insurance Study, marking the first time an InsurTech brand has ranked highest in one of J.D. Power’s insurance studies. Lemonade earned a score of 866 (on a 1,000-point scale), with Erie Insurance (865) and Allstate (841) rounding out the top three.

On the homeowners side, COUNTRY Financial ranked highest with a score of 855, followed by Amica Mutual (853) and Auto-Owners Insurance (843).

The U.S. Home Insurance Study examines overall customer satisfaction in the homeowners and renters line based on five factors: interaction, policy offerings, price, billing process and policy information, and claims. The study is based on responses from 11,942 homeowners and renters via online interviews conducted in June-July 2020.

- Customer experience is key to lifetime value, and 67 percent of homeowners insurance customers who’ve selected a brand based on good service experience say they “definitely will” renew with that insurer. Reputation (64 percent) and convenience (64 percent) follow as top drivers of intent to renew. Price as a reason for initial insurer selection is one of the lowest-ranked motivators driving homeowners customer retention.

- However, the study found that renters are more focused on price, with 52 percent of renters insurance customers choosing that as the primary reason for selecting an insurance provider.

- Nearly two-thirds (63 percent) of millennial homeowners have smart home products, and this age group is more than twice as likely as boomers to use insurer-provided tools to inventory their possessions. Customers who use these tools say they have a significantly higher level of engagement with their insurer, creating additional opportunities to add value through good customer service.

Source: Carrier Management

Sixfold Names Tony Rosa Chief Data & Analytics Officer to Advance AI-Driven Portfolio Intelligence

Insurtech Sixfold announced the appointment of Tony Rosa as Chief Data & Analytics Officer, a move aimed at scaling the company’s AI underwriting capabilities from individual submission analysis to strategic portfolio-level decision-making.

Equisoft/manage Earns “Luminary” Status from Celent Across North America and LATAM

Equisoft announced that its AI-native policy administration platform, Equisoft/manage, has been named a top-tier “Luminary” in Celent’s North American and LATAM Policy Administration System reports. The platform also received XCelent Awards for Advanced Technology across both regions, reflecting its broad functionality and innovative use of AI.

Markel Partners with Upfort to Strengthen Cyber Protection for US Policyholders

The partnership gives eligible policyholders access to Upfort Shield, a multi-layered, AI-powered cyber defense platform. The platform includes automated protection against common cyberattacks and an easy-to-deploy endpoint detection and response solution that uses behavioral analytics to reduce the risk of breaches. Service availability and pricing may vary by client.