By Stuart Maltas, Accenture

These archetypes fall into three categories: Migrate, Accelerate, and Grow & Innovate in the Cloud (MAGIC).

- Migrate brings cost benefits and resilience. A typical archetype here is the need to move applications and infrastructure fast and securely to the cloud. Key benefits include cost savings of up to 40 percent (if facilities are consolidated or closed).

- Accelerate is about building a modern IT stack for agility. Commonly, clients need to revamp their core administration platforms – their data centres and infrastructure – and rationalise, modernise and transform their applications. Key benefits of creating a cloud-based IT stack that offers intelligent operations and that uses maximum levels of automation include solving skills-availability issues and cutting the high costs of running outdated IT.

- Grow & Innovate involves reinventing business outcomes. Here, industry-led business reinvention is a common archetype, with clients using the cloud as a catalyst to generate new, data-driven, innovative business and revenue models, and to execute a wise pivot from legacy insurance distribution for sales and servicing. Key benefits include improving the firm’s market position and significant increases in customer numbers and customer retention.

For now, let’s focus on one benefit of the journey to the cloud that is perhaps less apparent: how it can help insurers to meet their environmental, social and governance (ESG) commitments.

Webinar: The data that matters to your life insurance customers. Learn more here!

Green computing

As ESG commitments become more pressing, sustainability is an increasing concern for clients – including those in the insurance industry. Consider this: seven of the world’s leading insurers and reinsurers, including AXA, Allianz and Swiss Re, are setting up the Net Zero Insurance Alliance, which will launch later this year to support the transition to a net-zero economy.

Cloud-based computing, also known as green computing, is one way for firms to meet certain ESG goals, as some global players have done by shifting their operations to the cloud.

Although clients typically understand the efficiency gains of a move to the cloud, they’re often less certain of the sustainability benefits. Questions I commonly hear are: What sustainability benefits could such a move bring? How can we minimise the carbon footprint of our IT operations? And how can we maximise the sustainability benefits resulting from migrating to the cloud?

I can’t answer every question here (though I’d be happy to hear from those interested in knowing more), so for now I’ll outline several reasons why cloud is more sustainable:

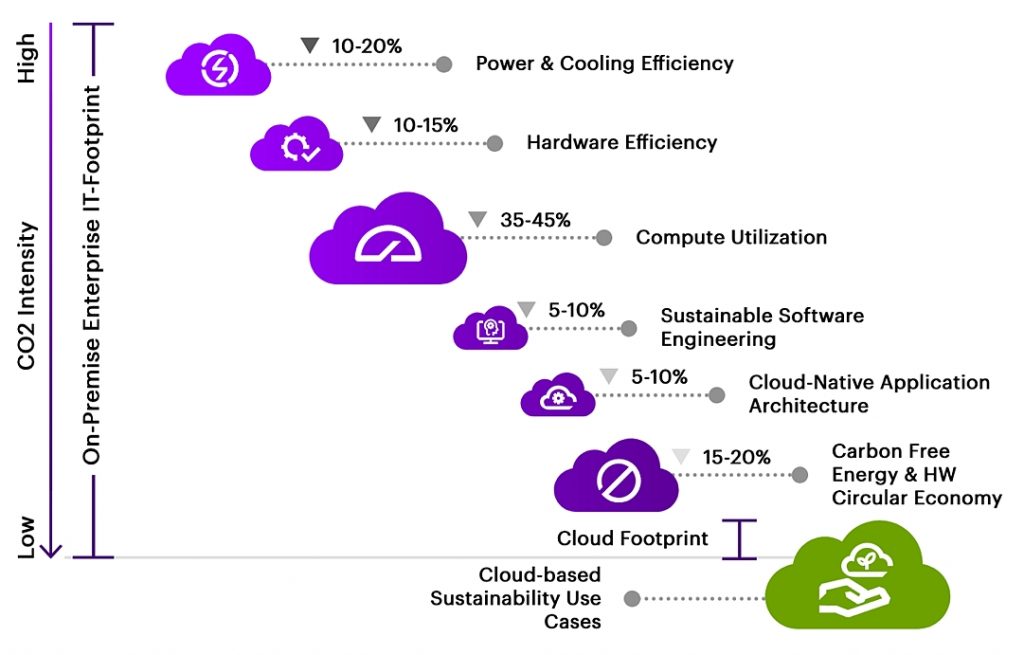

- The Migrate stage cuts IT energy consumption by removing the need to power and cool on-site data centres, for example, and by boosting the efficiency of existing hardware.

- The Accelerate stage cuts greenhouse gas (GHG) emissions beyond IT. How? By leveraging cloud and data, and by using new ways to work across the business.

- The Grow & Innovate stage, in some industries, can see supply chains transformed to include circular economy practices and by the replacement of high-carbon physical products with virtual equivalents, which is driven by the Internet of Things (IoT), 5G and using in-cloud data processing solutions. Across industries, optimising apps for cloud architecture, for example, can reduce associated carbon emissions by 98 percent.

More is less: The greater the ambition, the greater the reduction in carbon emissions

The graphic shows the incremental levels of carbon reduction that insurers can achieve with a move to the cloud – though this in part assumes that they select a carbon-thoughtful cloud service provider.

Although APAC-based insurers know ESG considerations are growing in importance, and while many ensure their assets are invested responsibly, few have taken significant steps along the sustainability road when it comes to technological solutions. This is a gap that’s easy to close, and it’s one that green computing delivers.

Journey to the cloud

Before I close, I’ll outline briefly how insurers can move from one archetype to the next, and how they can build on their journey.

- Step 1: For many insurers, this process could start with rehosting what’s held on private data centres, and moving to a cloud-native application that modernises the front-end.

- Step 2: Next, they could migrate their back-office software to the cloud. In this way, they could focus on enabling cloud services from platforms. They could follow that with a digital insurance ecosystem play to expand sales reach and improve agent efficiency.

- Step 3: A logical subsequent step could be to decouple their legacy backend policy administration systems (PAS), moving those to the cloud to take advantage of advanced technological solutions like data analysis, artificial intelligence and machine learning in the cloud to transform their underwriting, claims and related processes.

The journey to the cloud is imperative for insurers – in APAC as elsewhere across the industry.

Source: Accenture