With a degree in communications engineering, mother-of-three and insurance industry high-flyer, Monica Garcia Cristóbal is passionate about her work with Spain’s largest insurance provider, MAPFRE. As Director of Transformation, her role has seen her implement strategies and explore the largest tech trends globally so that MAPFRE can fulfil its commitment to innovation and exemplary customer servicing.

Perhaps one of the world’s most philanthropic insurers, MAPFRE also ploughs 60% of its profits into charitable and community-driven causes – an aspect that has cemented Cristóbal’s passion and loyalty for the company as she continues to lead it’s transformation journey. Insurtech Insights caught up with her in Barcelona, to find out more.

Tell us how you entered the insurance industry – what brought you here?

I’ve had quite a journey in my career, having worked in different industries and roles. I started in the telecommunications sector, specifically in Germany, where I was involved in telecommunications because I’d studied communications engineering. During that time, I developed a strong passion for how technology can add value to customer needs. I witnessed the impact of technologies like GPS and algorithms in providing better services and improving customer experiences.

After my time in telecommunications, I moved into the field of consultancy. In this role, I focused on strategy and digital transformation, assisting companies in their journey towards digitalisation. I was always driven by understanding how technology could create value for both the business and the customer.

It was during this phase that I had the opportunity to work with MAPFRE and after some time, they approached me with an exciting project. The project was centred around MAPFRE Spain, specifically MAPFRE Familia, which was led by our current President and CEO. The objective was to drive digital transformation within MAPFRE Familia, a significant portion of the company. It was a transformative initiative in the insurance sector, aligning with the industry-wide movement towards digitalisation.

Joining MAPFRE for this project was a pivotal moment in my career. We embarked on a journey to make MAPFRE Familia fully digital in various aspects. During this time, the insurance sector was experiencing its first wave of digital transformation, with companies across the industry embracing digital practices. Our focus was to ensure that MAPFRE Familia became an all-digital organisation, leveraging technology to deliver exceptional customer experiences.

Tell us about your journey to Head of Transformation at MAPFRE Spain

I’ve been at MAPFRE for 14 years now, and during this time, I have held various roles. I started as the head of digital IT at the corporate level and then transitioned to the role of head of digital business at the corporate level. More recently, for the past year and a half, I have been serving as the head of transformation in Spain.

Being in the role of head of transformation is truly fascinating. Our main objective is to leverage MAPFRE capabilities to drive change, enhance agility in our work processes, and digitise our operations across all our products, services, and distribution channels. We also focus on harnessing synergies within our digital businesses, including Verti, our digital insurance platform, and Savia, our digital health platform.

Another crucial aspect of our transformation efforts is to become a more data-driven company. We strive to incorporate data into all our processes, enabling us to better understand our customers’ needs and provide them with improved products, services, and communication channels. By placing the customer at the center of our decision-making and leveraging data-driven insights, we aim to deliver exceptional service and drive innovation.

As part of our commitment to innovation, my team in the transformation area is actively involved in MAPFRE Open Innovation, specifically leading innovation initiatives in Spain. We focus on driving impactful innovation that brings tangible benefits to our business and customers. This shift towards digitisation, synergy, agility, data-driven practices, and innovation is at the core of our transformation strategy.

You hold one of the most sort after senior roles in the insurance industry within Europe. What changes have you seen taking place in terms of more women coming into senior positions like yours?

In my experience at MAPFRE, I consider myself fortunate because I have witnessed equal treatment for all individuals, regardless of their gender. MAPFRE values people based on their education, skills, and the opportunities they choose to pursue. The company provides equal opportunities for growth and development, and it is up to each individual to seize them.

However, I must acknowledge that the insurance sector, like many others, is not yet fully representative of gender diversity. What I have noticed is that more women are now eager to step into leadership roles, and they are not waiting to be asked but are pushing for these positions. It is a matter of embracing the available opportunities.

Moreover, I have recently committed to building networks and supporting one another, breaking away from the traditional male-dominated circles. This shift in mindset is crucial to fostering diversity within the insurance industry. Education also plays a significant role. I strongly believe that a solid educational foundation is essential for personal and professional growth. Continuous learning, training, and studying lead to new opportunities and allow individuals to reach higher positions.

In addition to these efforts, MAPFRE, in particular, is dedicated to promoting diversity and ensuring fairness and equality within the organisation. The company is committed to creating an inclusive environment where everyone feels valued and respected.

However, I also recognise that the issue of gender equality extends beyond the insurance industry. Society and culture as a whole need to shift their perspectives. It frustrates me when I encounter outdated stereotypes, such as the assumption that technology is primarily a male domain.

As a tech professional, I challenge such notions because technology is omnipresent and impacts every industry. The lack of women in STEM fields, particularly technology-related roles, contributes to these misconceptions. It is our collective responsibility to address this disparity and create an environment where women are encouraged to pursue careers in any sector, including insurance, which is increasingly driven by technology and digitalisation.

I personally take it upon myself to educate my daughters about the omnipresence of technology. I emphasise that it is a driving force and an enabler in all sectors, whether they aspire to be journalists, artists, doctors, engineers, or anything else. Understanding technology’s value and potential empowers individuals to thrive in any field, including the insurance sector. It is heartening to see that our industry is actively driven by these values and continues to work towards a more inclusive future.

The move by MAPFRE to embrace digitisation in 2009 was forward thinking, considering their position as a leading incumbent.

I believe that MAPFRE has always had a strong drive for innovation right from the beginning. Just last week, we celebrated our 90th anniversary, and we started off as farm insurers, providing insurance specifically for farms. From there, we expanded into multi-insurance, becoming the first company in Spain to offer different types of insurance under one roof. As we continued to grow, we ventured into the international market and embraced digitalisation, not only through our channels but also by creating our digital business 11 years ago.

However, our commitment to innovation didn’t stop there. We recognised the importance of being part of a larger ecosystem, which led us to explore open innovation through partnerships with start-ups and investments in venture capitals. We have always been keenly aware of what lies ahead, not just from an insurance standpoint, but from an insurer’s perspective.

At the core of our approach is understanding customer needs. Our strong values are evident in our employees, our providers, and the value we deliver. We strive to provide value that aligns with the changing needs of our customers. As risks evolve, we adapt to provide security and peace of mind, whether it’s for individuals or companies. We continuously stay informed about shifts and changes in order to adjust and offer that value, which is truly the essence of what we do.

It’s this drive that has pushed us to explore new territories and opportunities ahead of many other incumbents. The way we operate today is vastly different from 14 years ago when I first joined MAPFRE. Our scope is broader, more global, and more connected. We understand the importance of being an ecosystem player, engaging with customers, co-creating solutions, and iterating based on their feedback. Innovation remains at the heart of MAPFRE, but the way we approach and implement it has evolved significantly over time.

You have a birds-eye view of the industry right now. What are the key digital transformation trends that are driving the biggest changes?

I have different perspectives that I’d like to share. You mentioned the perspective of how innovation and technology trends can impact various sectors, particularly in terms of artificial intelligence and cloud computing. As a communication engineer, I’ve witnessed the evolution of these technologies and the tremendous opportunities they bring. However, I also look at trends from a different angle—the perspective of driving transformation and disruption in the insurance sector.

One significant trend I observe is the shift in mobility behaviour. Just a few days ago, we launched a new personal mobility product at Verti, our fully online platform. We recognised that our customers’ transportation habits have changed, and we now cover individuals regardless of the means of transportation they use. This revolutionary approach has pushed us to adjust and cater to their evolving needs.

The same applies to the health sector, where the trend has shifted from merely focusing on healthcare to encompassing health and wellbeing. People are increasingly concerned about self-managing their wellbeing, which led us to develop a fully digital health platform through Savia. This platform integrates with ecosystems to provide a better lifestyle and promote longevity within the comfort of their homes.

Another major trend that significantly impacts us is the emergence of new risks. These risks, such as climate change and cyber threats, pose challenges in terms of modelling and underwriting. However, as a responsible company driven by the needs of society, we must find ways to address these risks and provide security for the future.

When these trends intersect with technology, it creates a new wave of disruption in the industry. It’s crucial for us to approach this opportunity with a sense of responsibility and diligence. I believe it presents an amazing opportunity for us to embrace and create positive change in the insurance landscape.

Where does MAPFRE stand on AI adoption?

We are actively exploring different avenues when it comes to adopting AI in our processes and products. We have implemented over 70 AI solutions across various areas, including improving efficiency, enhancing customer knowledge, and traditional AI applications. While we are also piloting generative AI, we approach it with a responsible mindset.

Let me give you some examples of how we’re leveraging AI in health insurance. We aim to provide comprehensive health and wellbeing solutions, and one way we do that is through digital physical therapy. We understand that many people struggle to consistently attend physiotherapy sessions, which can hinder their recovery. To address this, we have introduced a system where individuals can undergo physiotherapy at home using sensors and AI technology integrated into our app. This innovative approach ensures that individuals receive the care they need conveniently and effectively, leading to better health outcomes.

AI also plays a crucial role in combating fraud and enhancing underwriting accuracy. For instance, in small insurance cases, we utilise AI to assess risks more accurately. In addition to the information provided by customers and databases, we leverage satellite imagery and advanced data processing techniques to fine-tune our underwriting process. This enables us to provide tailored coverage and better address our customers’ needs.

Furthermore, AI plays a significant role in digital marketing and scoring. By leveraging AI algorithms, we can analyse customer data and preferences to deliver personalised marketing campaigns and offer more targeted solutions. This approach allows us to enhance the overall customer experience and ensure that we meet their specific requirements.

Through these AI initiatives, we aim to provide innovative and efficient solutions that benefit our customers and enhance their overall experience with our services.

What can we expect to see in terms of digital transformation and new developments over the next 12 to 18 months?

What I can share with you is that our focus is centred on delivering value directly into the hands of our customers. We strive to provide them with various means of contacting us and interacting with us. It’s important to note that not everything has to be digital, as our guiding principle is to ensure that no one is left behind. This principle holds significant importance for me personally, as I have observed that even my 86-year-old father is more comfortable with technology than my 50-year-old brother.

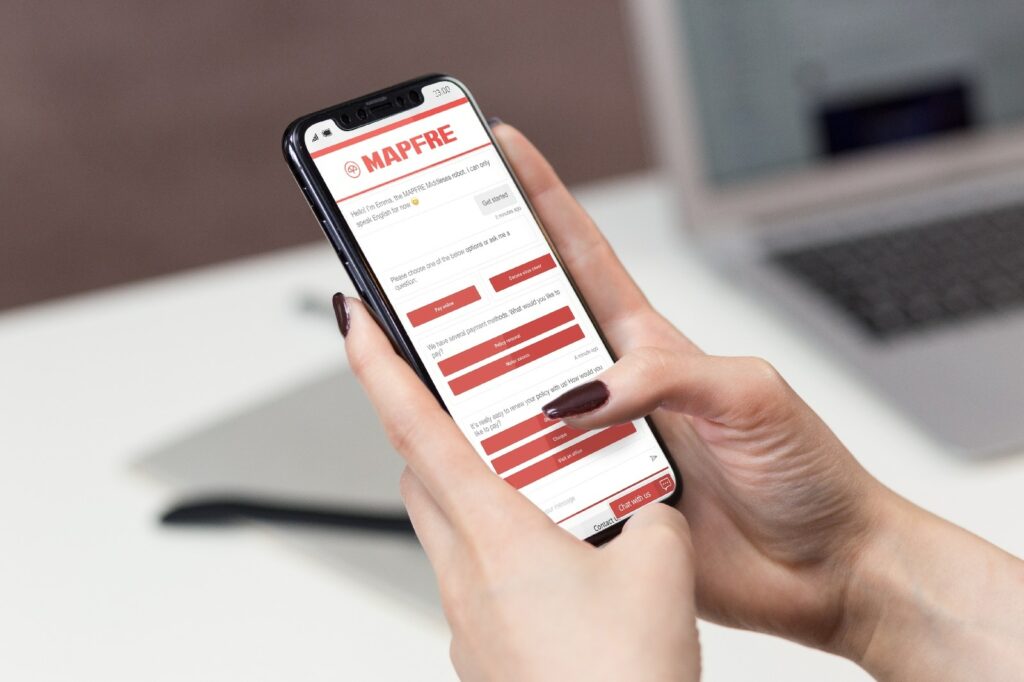

The simplicity, ease, and convenience of technology play a crucial role in his positive experience. He can communicate with devices, and they respond back. It’s this simplicity and convenience that we aim to provide to all individuals, catering to their preferred channels of interaction. Whether they prefer visiting our physical offices, making a phone call, using WhatsApp, or engaging with a virtual assistant, we want to ensure that they have a seamless and quick experience.

With the power of generative AI, our goal is to provide the best service and the right answers to each person at the precise moment they need it, regardless of their chosen communication method. This lies at the core of our approach – not just the digital capabilities we offer, but the impact they have on our end customers. Equally important are our intermediaries, who play a key role in serving our final customers.

We strive to make it easy for them to assist our customers, simplify the subscription and underwriting processes, enable quick and secure payment transactions, and ensure fraud protection to maintain fairness. This philosophy extends to all aspects of our operations, whether in the back-end, middle, or front-end processes. We always keep in mind that our ultimate resource is the customer, and our aim is to provide them with exceptional value.

What inspires you in insurtech today?

Prior to joining MAPFRE, I had the opportunity to work in a consultancy firm where I gained exposure to various sectors. It took me some time, over a decade, to truly grasp the value of the insurance industry.

From my personal perspective, I see insurance as a significant asset. When you observe an evolved country, you’ll notice a robust insurance sector. This sector acts as a safety net for society, instilling trust among individuals and facilitating new ventures.

Trust is the foundation upon which societies can grow and flourish, as it encourages risk-taking and fosters development. Conversely, in the absence of a strong insurance sector, trust erodes, resulting in a lack of security and hindered progress. I wanted to be part of a company like MAPFRE that prioritises trust and has Fundacion MAPFRE, which directs 60% of its revenue directly back into society. This allocation benefits culture, road safety, social initiatives, and more.

So, what inspires me each morning is knowing that the work I do, along with my team, contributes directly to society’s well-being and helps individuals in meaningful ways. It brings me a sense of fulfilment and purpose.

Interview by Joanna England

Joanna England is an award-winning journalist and the Editor-in-Chief for Insurtech Insights. She has worked for 25 years in both the consumer and business space, and also spent 15 years in the Middle East, on national newspapers as well as leading events and lifestyle publications. Prior to Insurtech Insights, Joanna was the Editor-in-Chief for Fintech Magazine and Insurtech Digital. She was also listed by MPVR as one of the Top 30 journalist in Fintech and Insurtech in 2023.