The new “Capitola Co-Pilot” artificial intelligence (AI) capabilities harness the power of GPT technology to offer brokers unparalleled productivity enhancements specifically designed to elevate the broker experience by improving efficiency and effectiveness, thus greatly increasing their book of business.

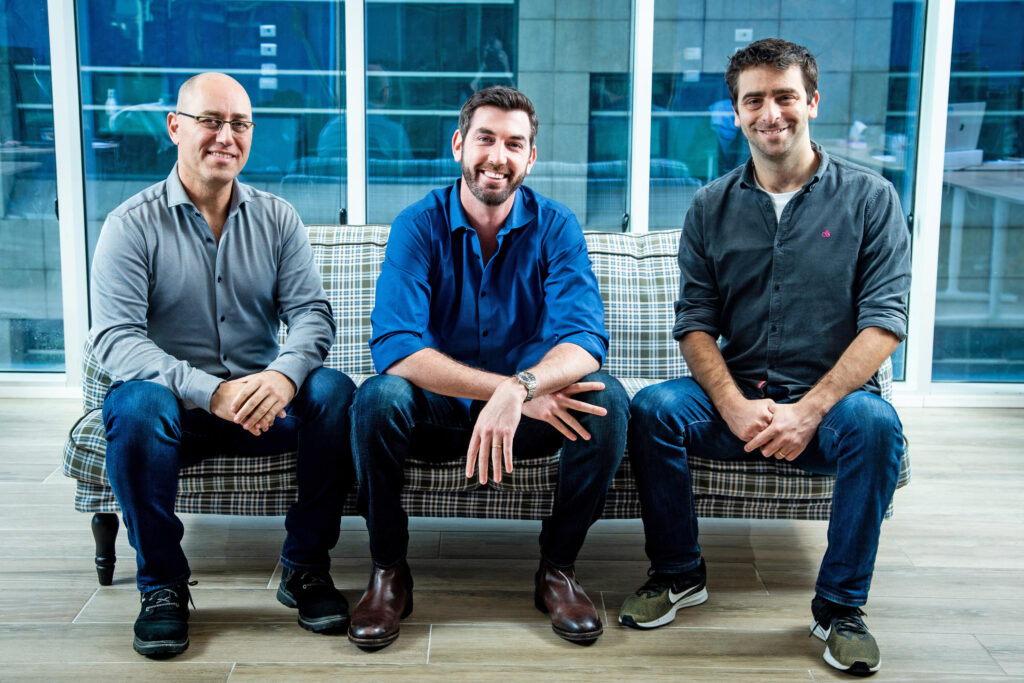

“GPT technology represents a tectonic shift in our ability to build tools that empower insurance professionals to broker better,” said Sivan Iram, Capitola’s co-founder and CEO. “As the first broker platform to implement GPT technology, Capitola continues to lead the market in its ability to streamline the placement process and provide smart market-intelligence recommendations.”

Generative Pre-trained Transformers (GPT) are a type of large language model (LLM) and a prominent framework for generative artificial intelligence designed to understand and generate human language. Within the Capitola platform, Co-Pilot is capable of:

Data Extraction: Using language models, Capitola Co-Pilot can be used to analyse and understand unstructured data, such as documents and emails, and derive insights from them. Earlier forms of AI could only understand the syntax, but with GPT technology, Capitola Co-Pilot can even understand the semantics. It can help read and compare quotes, provide recommendations to brokers, generate customer-facing materials, and more.

Data Enrichment: Capitola Co-Pilot models that are based on GPT can monitor and analyse relevant publicly available information and documents related to commercial insurance. By processing and summarising this information, GPT technology can provide brokers with valuable insights into market trends, regulatory changes, and competitive dynamics. This enables brokers to stay updated and make informed decisions in a dynamic insurance landscape.

Market Intelligence/Risk Appetite Matching: Capitola Co-Pilot strengthens a broker’s ability to map out carrier risk appetite and provide data-driven recommendations to find the right market for every risk. Its reasoning and inference capabilities are a game-changer for its ability to take in large amounts of data and synthesise it into actionable and insightful recommendations.

Specific productivity-boosting capabilities provided by Capitola Co-Pilot include:

Personalised Assistance: By leveraging data, Capitola Co-Pilot could provide personalised recommendations, policy comparisons, and tailored information to customers, potentially leading to increased customer satisfaction and loyalty, as well as assisting brokers in delivering more relevant and targeted services.

Automation of Routine Tasks: Capitola Co-Pilot significantly reduces manual tasks like data entry, documentation updates, and policy generation, freeing up brokers’ time, reducing errors and omissions (E&O) exposure, and enabling a focus on acquiring new clients and reducing churn.

ChatGPT is transforming the insurance space

“Capitola is excited to be the GPT pioneer in the digital commercial insurance domain,” said Naor Rosenberg, co-founder and CTO at Capitola. “GPT empowers us to revolutionise the way we interact with extensive unstructured information while ensuring utmost security and reliability. Witnessing the transformative impact of GPT on the world, we are thrilled to bring this best-in-class, secure, and robust technology to our valued clients, providing them with unparalleled solutions and peace of mind.”

Iram added: “Capitola Co-Pilot will help automate processes and remove redundant and repetitive tasks, thus freeing brokers to focus on the human elements of insurance brokering, such as providing excellent client service and building relationships with underwriters.”