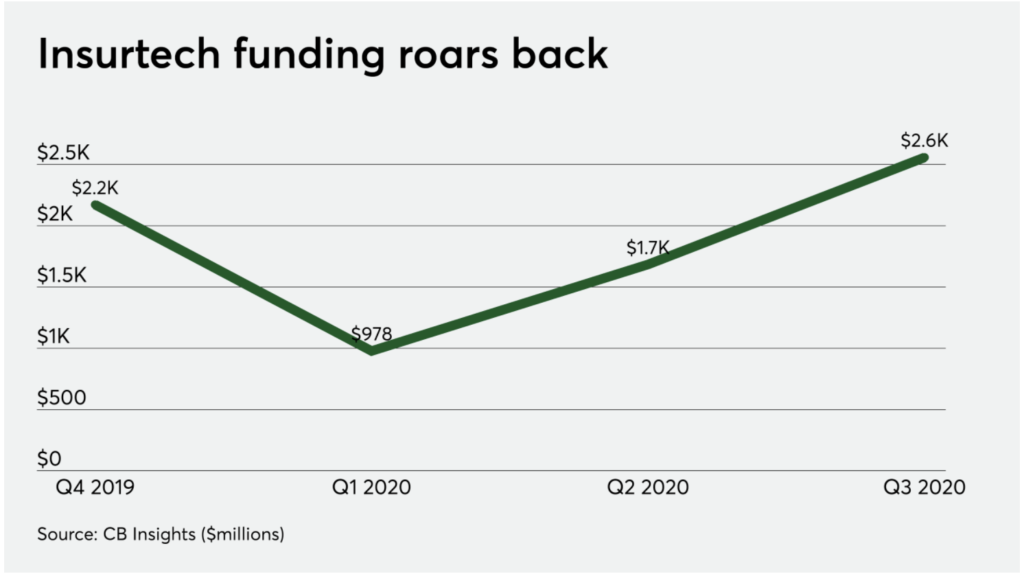

Insurtech funding rose 52% from the second to third quarter, according to CB Insights’ State of Fintech Q3 2020 report.

Funding reached $2.56 billion in Q3, up from $1.7 billion in Q2 and $978 million in Q1. In the third quarter of 2019, funding was just under $2 billion.

Nearly half of that funding came from five megadeals:

- $500 million for Bright Health

- $250 million for Next Insurance

- $230 million for Waterdrop Inc.

- $150 million for Hippo

- $130 million for PolicyBazaar

The top 25 insurers completed 66 total deals so far in 2020, the most ever for this cohort on a year-to-date basis. In total, 318 VC deals were completed in the first three quarters of the year, rising from 99 in Q2 to 105 in Q3.

Source: Digital Insurance

Reserv Named to Forbes Fintech 50 for Claims Technology Innovation

Reserv, a leading claims and claims technology provider, has been recognized in the 2026 Forbes Fintech 50, marking a significant milestone for the company. Out of 50 companies on the list, Reserv is one of only five in the insurance sector and the sole firm focused specifically on claims and claims infrastructure.

CRC Group Completes Acquisition of Euclid Transactional to Expand Specialty Capabilities

CRC Group has completed the acquisition of Euclid Transactional from private investment firm Searchlight Capital Partners, expanding its capabilities in financial and professional lines underwriting. Financial terms of the transaction were not disclosed.

Andrew McGee Named Chief Broking Officer for Howden UK&I Retail

Global insurance and reinsurance broker Howden has appointed Andrew McGee as Chief Broking Officer for its UK & Ireland (UK&I) Retail division, strengthening its leadership team as the firm continues to expand its retail operations.