Insurance companies can substantially improve the benefits they gain from cloud computing if they align their business needs with the products and services offered by big cloud providers.

Some technologies are critical to insurers but bring cloud providers little extra revenue.

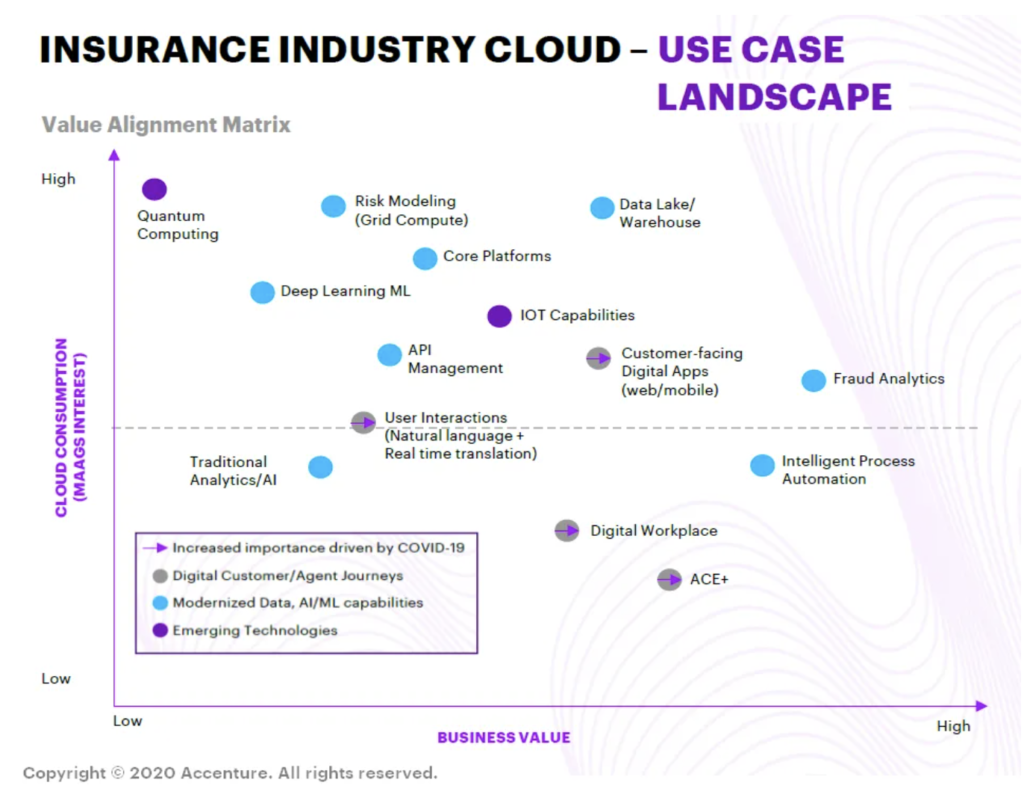

This value-alignment matrix is a broad guide. It maps the current and expected needs of insurers against the average cloud consumption requirements of users of Microsoft, Amazon, Alibaba, and Google’s (MAAG’s) cloud services. Each of these cloud service providers has a wide product set. The features and pricing of offerings, such as Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS), can vary considerably. Insurers should look carefully at the products and services offered by each of the major cloud providers and align themselves with the companies that will best serve them now and in the future.

Migrate, accelerate, grow—as businesses progress along typical cloud journeys, business value can be amplified if it is defined and actively pursued.

Business benefits are often overshadowed by the search for cost savings.

A business-driven cloud agenda is a big change from the way insurers have tended to view the cloud in the past. Cost savings, as I mentioned in my previous blog post [Link], are the most common motive for insurers moving to the cloud. Better control and management of technology resources come next. Business benefits, such as greater agility or the ability to scale new services or applications, rank much lower.

A business-driven agenda requires insurers to manage three key steps as they journey further into the cloud.

Migrate: Migrating infrastructure and software to the cloud reduces IT operating costs and the “technology debt” caused by inefficient legacy systems, and provides users with scalability on demand.

Accelerate: By building on robust cloud infrastructure, insurers can accelerate technology enhancements and speed up business efficiency improvements. Quick gains include service center enhancements, reduced administrative reworking, and less IT down time.

Innovate and Grow: Platform solutions allow insurers to hasten business improvements and enhance risk management. A variety of proven solutions, which continue to be upgraded, are available for applications such as claims processing, product distribution, and business development.

Technology improvements and cost control are important components of any cloud agenda. But they should never overshadow the business benefits of cloud migration.

Vertafore and NetVU Reveal Education Lineup for Accelerate 2026 in Las Vegas

Vertafore, a leader in modern insurance technology, and the Network of Vertafore Users (NetVU) have announced the first round of education sessions for Accelerate 2026, set to take place from April 13 to 16, 2026, at the Fontainebleau Las Vegas. The event will focus on the theme “Powering Your Possible in the AI Era,” highlighting how artificial intelligence is transforming the insurance industry and empowering professionals to turn innovation into action.

HSB Canada Launches Comprehensive Cyber Insurance Solution HSB CyberPro for Canadian Businesses

HSB Canada, a specialty insurer and part of Munich Re, has introduced HSB CyberPro™, a new solution offering comprehensive cyber insurance coverage and services designed to help businesses respond effectively to cyber threats. The innovative product provides protection, support, and tools to help organizations navigate the growing complexity of cyber risk in today’s digital environment.

AXA Partners and bolttech Announce Strategic Partnership to Drive Embedded Insurance Solutions Across Europe

AXA Partners, a wholly owned subsidiary of the AXA Group, and bolttech, a leading global insurtech, have announced a new long-term strategic partnership aimed at delivering embedded insurance and assistance solutions across the European Union, the United Kingdom, and Switzerland.